Recording your income and expenses can seem like a daunting task, but even if you just do it on a macro level of “money in, money out,” it’ll reveal a lot about how much you need to cut and areas where you might be able to save. Your cash flow and general financial situation are also important for choosing what kind of budget you need to follow. If you find that your spending exceeds your income by a lot, for example, you’ll need to choose a shorter timeline, perhaps weekly, that helps you keep an eye on your expenses. If your income is comfortably higher than your expenses, though, you can follow longer-term budgeting to focus on optimizing your savings.

Analyzing your income

There are two major types of income to consider: regular and irregular. Both are fairly easy to account for but have different implications for how you choose to budget.

Regular income

Regular income is money that arrives consistently on a daily, weekly, or monthly basis. This could be a salary from your job, steady income from working a fixed number of hours, some form of financial support, or any other reliable money you have coming in.

Calculating regular monthly income is easy: if it’s the same every month, you can just use that number. If it shows up on a different basis, like bi-monthly or quarterly, try to divide it down into individual months.

Irregular income

Irregular income can be trickier. If you work variable hours, depend on constantly-changing freelance work or clients, get paid on commission, or have a tipped job, you may have significant changes from month to month.

You can get a picture of your irregular earnings by adding them up over at least three months. The more data you have, the better. Then divide the total by the number of months you used to get a monthly average. Adjusting this estimate downwards slightly may be a good idea, just to be safe. If you also have a regular income, you can simply add it to the average of your irregular income.

Budgeting with your income

If your income is mostly regular, you’ll have an easier time automating your contributions to savings and predicting your progress towards financial goals. A weekly or monthly budget is often a good choice here, as you can sync your budgeting with your income.

Budgeting with irregular income is a bit trickier, as you have to account for potential variations and ensure that automatic payments or transfers don’t cause any of your accounts to overdraw. In this situation, it’s a good idea to use your lowest-earning month from the last year or two as your base income estimate. This way, you’ll end up with a budget surplus most of the time, which will help build your emergency fund (which everyone should be putting money into regardless of income type), insulate you from income shocks, and keep your savings deposits consistent. Using a monthly or even quarterly budget can also help smooth out variable income.

Analyzing your expenses

Now that you’ve gotten a general picture of your average income, you’ll need to do the same for your expenses. This is a little more complex, but there are just two main categories you need to worry about:

- Fixed expenses, which are generally necessary, regularly-occurring, and stable (like rent).

- Variable expenses, which may be discretionary and can change on a daily, weekly, or monthly basis (like dining out).

Fixed/regular expenses

Fixed and/or regular expenses tend to stay fairly constant and predictable. Rent, utility bills, loan payments, monthly subscriptions, and insurance payments are some of the most notable items in this category and probably account for a large chunk of your spending every month.

Though many of these fall in the “needs” category, meaning you can’t eliminate them, reducing fixed costs is possible in the long run. Some require a big change, though, like moving to a lower-rent place, refinancing a loan, or finding a way to significantly lower utility bills.

Some regular expenses, like phone plans or subscriptions to services, can be changed with relatively little effort, though. These savings can add up quite a bit over time, they’re worth looking into when you have the time.

Calculating your fixed expenses is fairly easy since they tend to bill regularly for a steady amount. Adding up your regular bills and any other regular expenses you notice shouldn’t take very long if you have access to a few months of financial records.

Irregular/variable expenses

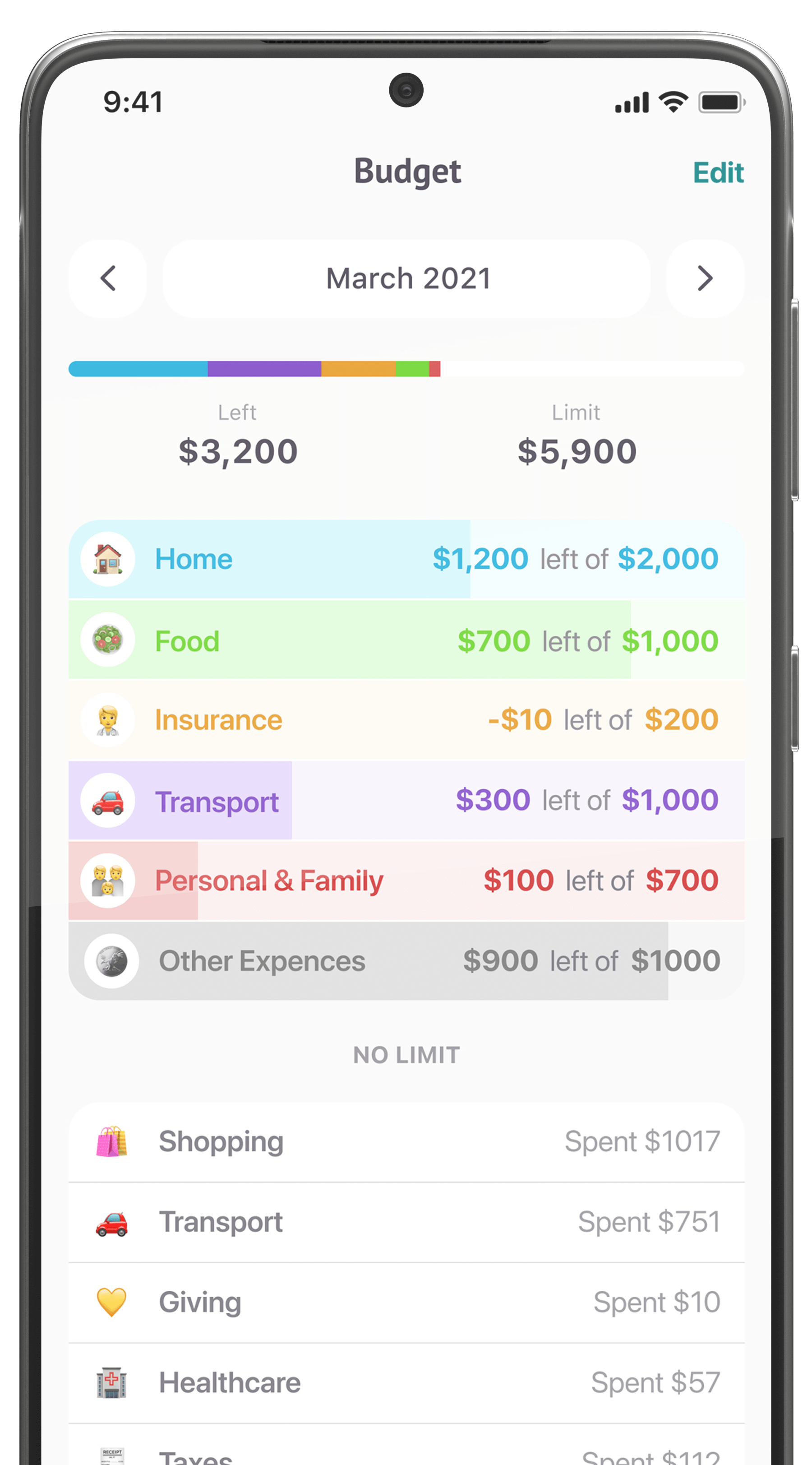

Expenses that change from month to month or day to day, like food, travel, and entertainment, are harder to keep track of, especially if you’re doing it manually rather than using an app or a program. However, this is where you probably have the most flexibility in your budget, so getting a good picture of your variable expenses is important if you want to optimize your savings.

Calculating your variable expenses

Adding up and categorizing every single purchase you make is the most accurate way to calculate your variable expenses, but doing that manually is a lot of work. It’s a good idea to use software that can do this for you or get a broad overview of your variable expenses without going through every line item of your spending.

To estimate your variable expenses, you’ll want to use at least three months of data. For each month, calculate your total spending and regular spending (rent, utilities, et cetera). Then, subtract your regular spending from your total expenses. If you’ve been saving, subtract that as well. The number you have left should roughly represent your variable spending for the month.

Averaging that number over several months should give you a decently accurate estimate of your total variable spending, though if you want to break it down into categories to better understand where your money is going, you’ll have to do that on a line-item by line-item basis.

Creating a budget

Making a budget doesn’t mean planning out every single purchase in advance. The main goal is simply to spend less than you make and save the surplus, and there are a lot of different ways to go about that. If you’re a detail-oriented person or you specifically want to work on spending less, you’ll probably want to use a short-term budget or one that sets specific limits on certain spending categories, like weekly budgets or the envelope system. If you want to take a more macro approach, dividing your income into broad monthly percentages for needs, wants, and savings could work for you. Choose a timeline and a technique that you think will help you reach your goals and, most importantly, that you think you can stick with.

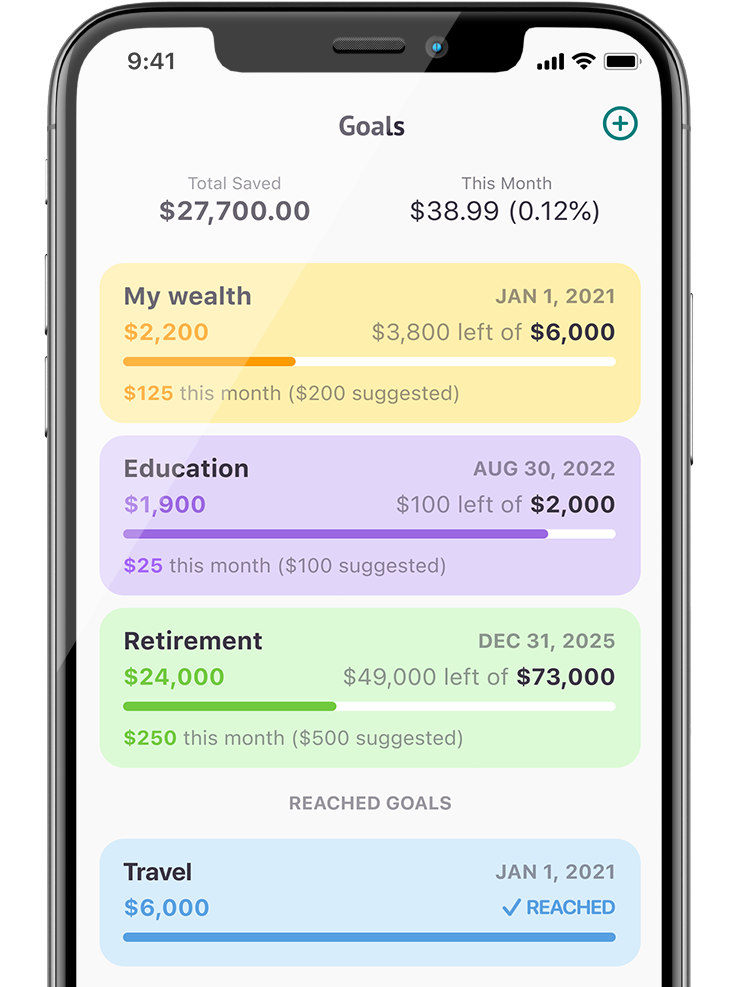

If you have specific targets you’re trying to hit, try to calculate how much you’ll need to save each month to reach them. For short and medium-term goals that are a few months or years away this will be pretty straightforward — just divide the amount by the remaining number of months.

Long-term goals can be more difficult, as you have to take into account expected rates of return on long-term investments, which can be significant. For these, it’s best to find detailed tools and guides that can help you build a good portfolio and estimate your necessary monthly contribution.

Choosing a budget

Daily budgets and yearly budgets have their uses, but unless you’re confident that you’ll have the time and/or planning skills to pull them off, you should probably consider weekly, monthly, or quarterly budgeting.

Daily budgets

Daily budgets should be fairly general, focused more on your total daily spending and your spending on certain categories than on the individual purchases you make. They’re most useful if you have certain habitual expenses that you can track and change, but they’re easily thrown off by large bills and unexpected expenses, and therefore not the best for getting a sense of your overall financial health.

Weekly budgets

As a general rule, the more you need to focus on controlling your spending, the shorter the amount of time you should budget for. This gives you more perspective on quickly purchases add up. A $100 purchase might be 10% of a weekly budget but just 2.5% of a monthly budget, for example. The net result is the same, but chances are you’ll think more about the purchase if it’s framed as 10%, since you may have to cut something else within in the next few days to make up for it.

A weekly time horizon also means you can rebalance and adjust your budget fairly often. If your spending goes over one week, you can try to compensate for it when you start over in a few days. Weekly budgets pair pretty well with the “envelope system,” where you set aside a certain amount of money for certain spending categories (either in physical envelopes or separate accounts) and only spend that money.

Monthly budgets

However, weekly budgets are strongest when it comes to managing your variable expenses. Regular/fixed expenses usually occur once a month (or even less often) and these are easiest to account for every month. That’s why monthly budgets are a justifiably popular default for many people, and if you don’t think you need to focus a lot on your day-to-day spending, they’re probably a good choice.

You don’t have as much flexibility or as many opportunities to adjust, but you can use something like the 50-30-20 system, which recommends spending 50% of your budget on needs, 30% on wants, and 20% on savings. Depending on your style, this can be a hands-on, planning-heavy budget or a relaxed budget where you just check your progress and adjust your spending every few days.

Quarterly budgets

If you want to zoom out even more, a quarterly budget might be helpful. Budgeting for three months requires some planning, but if you expect your expenses to remain regular for a while, this can be a good way to give yourself a longer time horizon.

Quarterly budgets can be especially good if your income or spending tends to happen on a more irregular basis, as it can even out high and low weeks and months into a more predictable pattern. It also works well as a way to set longer-term goals for yourself to meet with your monthly or weekly budgets, which can be very helpful for ensuring that if you exceed your budget in one cycle you’ll cut back to compensate for it in the next.

Yearly budgets

Making an effective yearly budget requires some planning, but it can help you set the tone for your monthly and even weekly goals. Estimating your yearly income and setting a goal for how much you want to have saved by the next year can be very helpful in giving you something to work towards. However, a lot can change in a year, so yearly budgets should be relatively flexible in response to month-by-month changes.

Start budgeting

There are a lot of different philosophies and opinions about budgeting methods, but they all break down into the same core components:

- Things you need

- Things you want

- Savings

The ultimate goal of a budget is to find a balance between these three categories that allows you to regularly save enough money to make progress towards your goals.

It’s okay to make mistakes when you start budgeting, of course—it’s an ongoing journey rather than a one-time event. You’re likely to overestimate your expenses in some categories, underestimate them in others, and forget about some entirely when you make your initial plan. Try to make budgeting into a habit, checking up on your daily, weekly, and monthly expenses and adjusting your budget categories up and down until you arrive at a budget that you can feasibly stay within every month. Budgeting software that automatically tracks your spending is a great way to stay on top of this without going crazy.

Especially in the beginning, try to set aside a certain percentage of your money each month for expenses you didn’t expect or may not have accounted for, putting it in an account designated for emergencies if possible. Uncertainty is a constant in life, and having that reflected in your budget will save you some trouble in the future and help even out any initial miscalculations.