With the new year comes new trends in fintech. Finance has historically been a somewhat conservative industry, but it’s steadily moving closer to the “unrelenting disruptive change” model that the tech sector has embraced. A lot can happen in a year of fintech innovation, and in 2020 most of that activity will probably be centered not only around exciting advances in technologies like artificial intelligence and blockchain but in the broader trend of traditional financial institutions trying to compete more directly with fintech and vice versa.

The lines blur between fintech, traditional finance and big tech

Fintech and banks have been partnering up at a steadily increasing rate throughout the last several years, and that trend is likely to continue into 2020 and beyond. Fintechs need traditional financial rails and banks need innovative digital solutions to replace their slowly-evolving tech, so, while there’s still a strong element of competition, fintech and traditional finance have also found areas of symbiosis. Ally has partnered with Better.com, Axos with N26, Fannie Mae with Plaid, et cetera. Some banks, like Goldman Sachs, are even investing in and acquiring fintech as part of their efforts to expand their portfolios and product offerings.

On the competition side, though, some fintech companies are moving towards traditional financial services. The proliferation of low and no-fee stock-trading apps like Robinhood, Stash, and MoneyLion has led to major brokerages cutting fees across the board, for example. The wave of fintech expanding from single-focus apps into areas like high-yield checking and savings accounts, money transfers, loans, mortgages, student debt, and other traditionally big-bank activities doesn’t look like it’s about to slow down.

Even non-financial tech companies like Facebook, Apple, Google, and Amazon are making their initial forays into the realm of financial services. So far, most of their products depend on existing institutions to provide the back-end functionality, which is opening up opportunities for banks like Citi and JPMorgan Chase to establish themselves as “banking-as-a-service” providers.

Blockchain goes mainstream with decentralized finance and smart contracts

Decentralized finance, often shortened to “DeFi,” refers to putting traditional financial services on blockchains, often making an effort to conform to existing regulatory frameworks and integrating with existing financial products. Essentially, the hype behind crypto is giving way to a more general recognition that blockchains and cryptocurrency make a lot of financial transactions easier and people will adopt it if it gets a bit user-friendly and safe. The technical difficulty and risk associated with cryptocurrency have been barriers to adoption for quite some time, but that might be about to change.

Decentralized financial products are often built on open protocols, like Ethereum, and require low levels of trust from their users, so a lot of initial projects are aiming at providing services like money transfers and loans to underbanked populations. The projects themselves, though, are slowly starting to move towards competition with traditional finance in mature markets as well.

Companies like Dharma, Compound, MakerDAO, BlockFi, and dYdX are already allowing people to borrow, lend, and earn interest on crypto. Polymath, Harbor, and tZero are working on crypto investments. Bitwise is making progress towards a crypto ETF. Two cryptocurrency-focused banks, SEBA and Sygnum, have been licensed by FINMA, the Swiss banking authority. That’s not even mentioning the other long-term trend of traditional banks like JPMorgan, HSBC, Bank of America, and even Wells Fargo investing in crypto and blockchain projects.

Smart contracts are another blockchain-powered solution that’s expected to get a lot of attention in 2020. A smart contract is a set of code that runs on top of a blockchain and automatically executes when a set of conditions are met, allowing transactions to take place without third parties acting as intermediaries.

Derivatives contracts, for example, could be automatically put into action by a smart contract that checks prices from multiple trusted sources and settles the contract at that price according to the conditions set by both parties. This has the potential to save quite a bit of paperwork, speed up transactions, and lower costs, and while they’re still relatively untested in finance, smart contracts have already been applied to great effect in fields like supply chain logistics, real estate, and healthcare.

Artificial intelligence goes to work

Finance is a data-rich environment, and AI is giving companies the ability not only to manage all that information but mine it for insights and automatically act on them. As predictive analytics and machine learning get more powerful and accessible, companies will increasingly depend on them for tasks like risk management, fraud detection, trading, and key business decisions.

MasterCard, for example, recently acquired Brighterion — an AI company whose algorithms can be used to accurately distinguish between legitimate and fraudulent transactions. Algorithmic trading is another notable case with companies like Kavout, Epoque, Greenkey, Auquan, and more developing AIs to help trade assets more quickly and effectively.

AI is also disrupting the financial services labor force as it’s becoming a more realistic alternative to human workers in many areas. Chatbots can handle a lot of routine customer service needs, and AI, along with less-sophisticated robotic process automation (RPA) can streamline a lot of regulatory, logistics, supply chain, and analytics processes.

Quill, for example, is an AI tool developed by Narrative Science to convert raw data into human-readable insights and visualizations, much like a human analyst might do. This kind of innovation can be applied to everything from filling out boilerplate forms to putting together complex risk assessments, all with minimal human supervision.

All that said, AI is by no means a plug and play technology just yet, and while 2020 is likely to see increased interest and application by startups and companies with the budget to incorporate it into their systems, it’s still not quite within reach of small and mid-size financial institution. That, however, is a clear market opportunity for fintech startups looking to apply their AI expertise.

Regtech booms, thanks to a simultaneous increase in both regulation and tech

Another hot topic, especially given steadily-increasing regulatory burdens on both finance and technology, are technologies that can help financial institutions more easily comply with legal requirements. Handling this in-house is prohibitively expensive, but so are the fines for noncompliance, so regtech companies have seized the opportunity to provide more efficient, cost-effective reporting and compliance systems. They’re doing everything from cookie management on websites to cryptocurrency KYC and fraud prevention.

Regtech isn’t a one-trick pony, either: it’s taking advantage of innovations from across the board. Companies like ComplyAdvantage and Ascent, for example, are applying AI to risk management and automatic policy updates, while Chainalysis and IdentityMind offer blockchain forensics and compliance options for cryptocurrencies, ICOs, and related financial companies.

AI, in particular, is shaping the future of regtech, as it allows for predictive problem-solving, real-time analytics and risk alerts, and even assistance in identifying and fixing compliance issues. Robotic process automation (RPA) is also hugely helpful in staying up-to-date with everything from the latest requirements for preparing and filing the necessary paperwork. Feedzai, for example, gives banks and payment processors the ability to use past data to assess the legitimacy of transactions, while Continuity keeps an eye on regulatory changes and helps companies automatically update their processes to stay on the right side of the law.

User data protection and privacy is one particularly hot area of regtech right now, but automatically-generated visual analytics, risk management, KYC/AML, cybersecurity, and general IT standards are also evolving towards more modular, specialized systems.

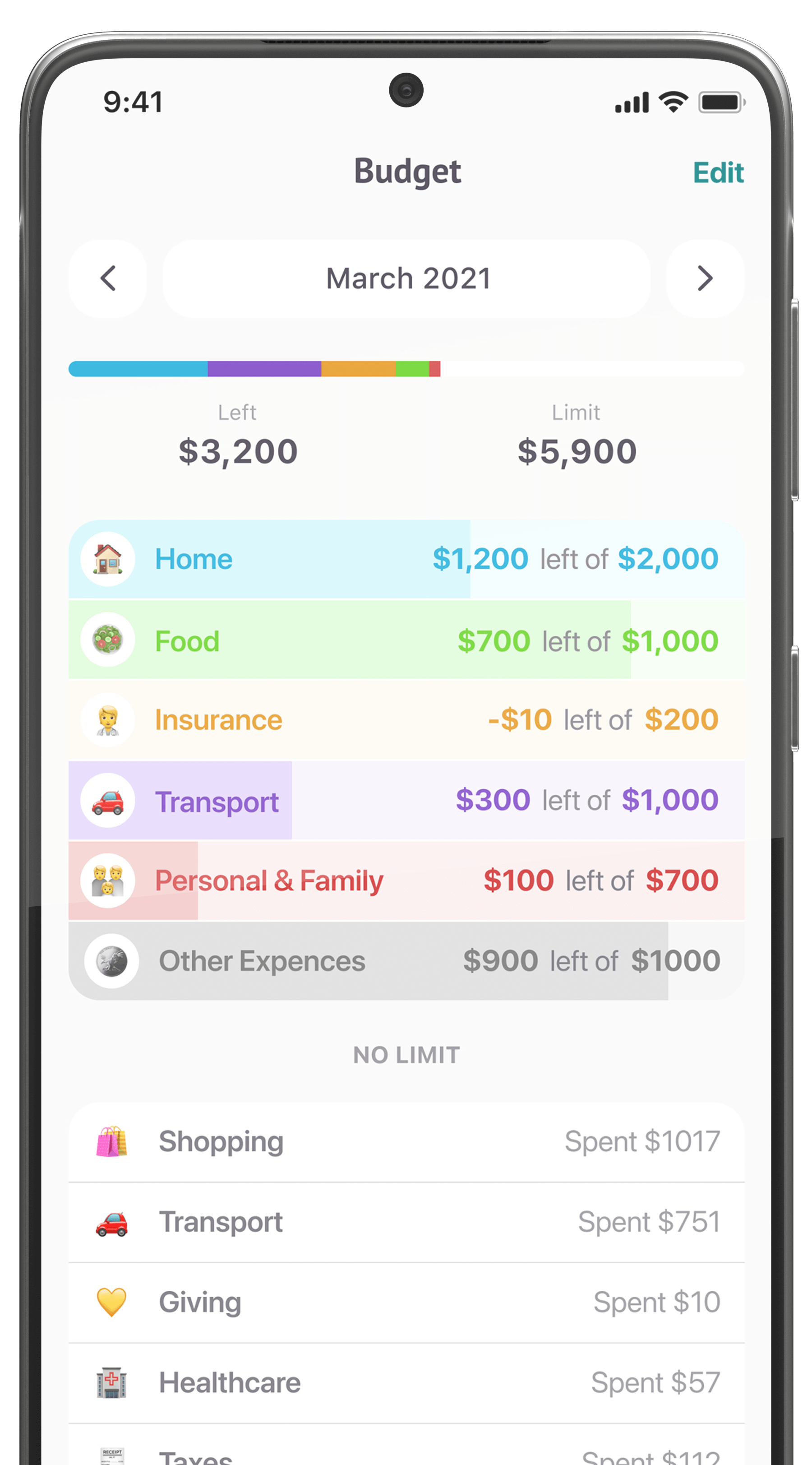

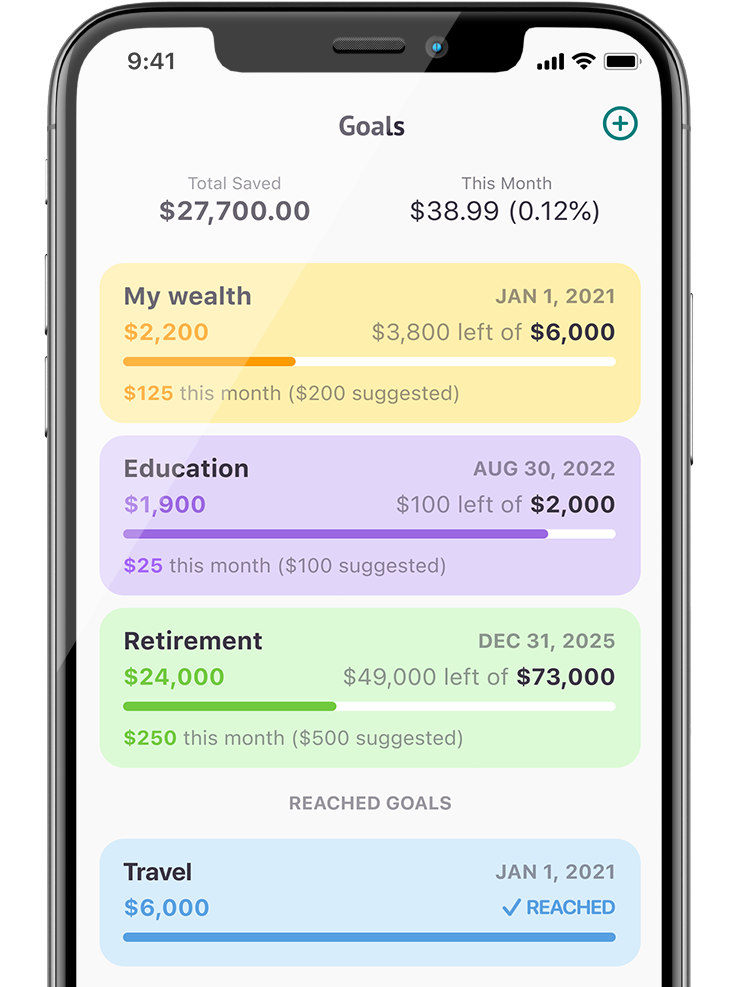

Digital-only banks continue to gain popularity

Tech-savvy generations in developed countries are growing increasingly comfortable with digital-only “neo” or “challenger” banks, with in-person bank predicted to continue their precipitous decline. Many traditional banks, though, have been responding by introducing competing products, acquiring their startup competitors, and increasing partnerships.

Ultimately, this points to most day-to-day banking needs inevitably moving online, especially as digital-only banks continue to increase the attractiveness and variety of products they offer. Higher interest rates, sleek mobile experiences, personalized financial recommendations, and other perks are being incorporated into a growing number of these next-generation banks, and adoption is likely to trend upwards in pretty much every market.

Mobile-first populations in emerging markets are also a huge potential source of growth here. The historic lack of financial inclusion and infrastructure combined with the sudden spike in mobile internet access makes digital banking a natural fit for large populations spread throughout Africa and Asia.

Looking beyond 2020

Ultimately, fintech is about making things easier and smoother — not just for customers, but for anyone connected to the financial services industry. Blockchains and AI are complex technologies, but when implemented well, they can cut out a lot of unnecessary steps and actually make life a bit simpler. Why have a third party administrated your contract if an algorithm can do just as well? Why have humans answer basic questions and perform simple account operations when a chatbot can take care of all that? As tech trends make clear, there’s no telling what finance and financial technologies will look like in a decade, but they’ll almost certainly be easier to use and more convenient for a lot of people.