Humans aren’t great at making objective, long-term decisions—like saving money. It not only means giving up utility in the short term, but also adjusting your savings rates when your income varies and paying attention to an ever-more-complex array of accounts and savings options. Luckily, robots are great at this kind of thing, and artificial intelligence is in the process of becoming more easily applicable and scalable at the consumer level. Saving has been getting more and more complicated over the past few decades, but the growing availability of AI-powered tools to help you squirrel away money could finally help reverse the trend and make it easier.

Why humans are bad at saving money

According to the OECD, the average American household currently saves around 3% of their income, which is almost at a historic low. Numbers are similar in the UK and many other industrialized countries, thanks to factors like rising costs of living, student debt, and slowing economies. With times getting a bit tighter, then, it’s important to find smarter ways to save—but why are we so bad at doing that?

There’s a concept in economics called “temporal discounting” which basically states that things are more valuable to us now than they are in the future. There’s a lot of math behind figuring out exactly how we devalue things over longer time horizons, but the basic idea is pretty clear: all other things being equal, we prefer to get stuff now instead of later. If it’s a choice between watching numbers in a bank account tick up and enjoying your money now, it’s our instinct to pick the latter. Saving also requires us to put forth some extra effort, which makes it not only unpleasant, but hard. We have to open accounts, figure out how much money we can afford to save, and deposit it on a regular basis. How much we can afford tends to vary according to our income and expenses, so we have to recalculate fairly often. A lot of what influences our saving habits, though, comes in the form of invisible nudges. Indeed, something as simple as changing a checkbox from “Opt-In” to “Opt-Out” can significantly change our behavior. Insights like these, combined with AI, can create some powerful tools to help us save by making the tools we use more intuitive, automatic, and effective.

How AI can save us (and also help us save)

Artificial intelligence feeds on data. The better the data, the smarter the AI can become. That’s why personal finance is a fantastic spot to put an AI: you have years of highly-accurate, well-structured financial data with clearly identifiable patterns and outcomes. Artificial intelligence basically works by looking at large amounts of past data and using it to figure out how to react to new situations, so it can use your income data to assess your spending and saving habits and help you optimize them.

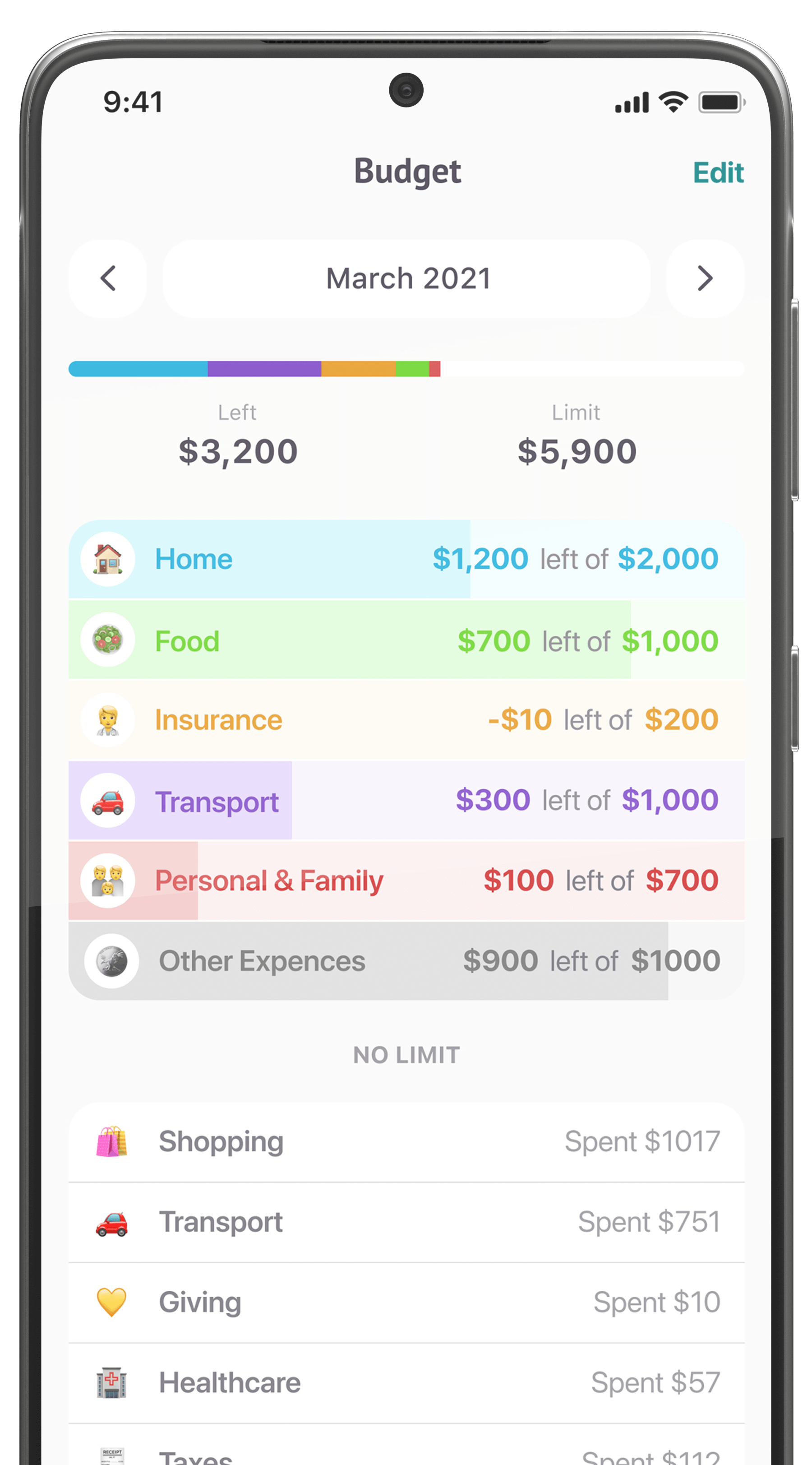

Most savings AIs are focused on calculating how much you can afford to save on a monthly basis. They calculate this by figuring out how much you tend to earn and how much you tend to spend, then looking at your current income levels to see how your paycheck matches up. If your paycheck is higher than usual, the AI will probably suggest that you save more; if it’s a lot lower, the AI might not suggest any savings at all, since you need to cover your expenses first. This takes care of a few problems: it takes all the work out of calculating how much you can afford to save; it updates in response to your income; and it either nudges you (through advice) to transfer some money into savings or it just goes ahead and makes the transfer itself. The most a human needs to do is approve of the AI’s decision and possibly send some money to a different account.

AI saving assistants can also do transfers more frequently than a human might be motivated to, since they don’t really take days off or get lazy. This means that instead of hitting your account for a big savings contribution once a month, it can take multiple small deposits every week, every few days, or even from every transaction. This overcomes another stumbling block we have: it hurts a lot more when we see big numbers leaving our accounts, but we hardly notice a few dollars here and there.

Every assistant works a little differently, but the two main flavors are:

- Advice bots: These can come in the form of chatbots or self-contained apps. Basically, they monitor your finances, give you suggestions, and answer your questions.

- Account management bots: These bots not only give you helpful tips—they actually transfer money between your accounts as needed.

The first is an excellent tool to help you make financial decisions and analyze your income/expenditures, while the second is best for actually implementing a savings strategy. They tend to have good security practices (read-only access to your financial info), sleek mobile (sometimes mobile-only) interfaces, and intuitive savings strategies. AI is also what drives the natural language processing (NLP) that many apps use to understand human speech, but this has fairly little impact on the actual savings process.

AI savings apps

New AI-based savings tools are popping up every day, but here is a small sample of currently available services:

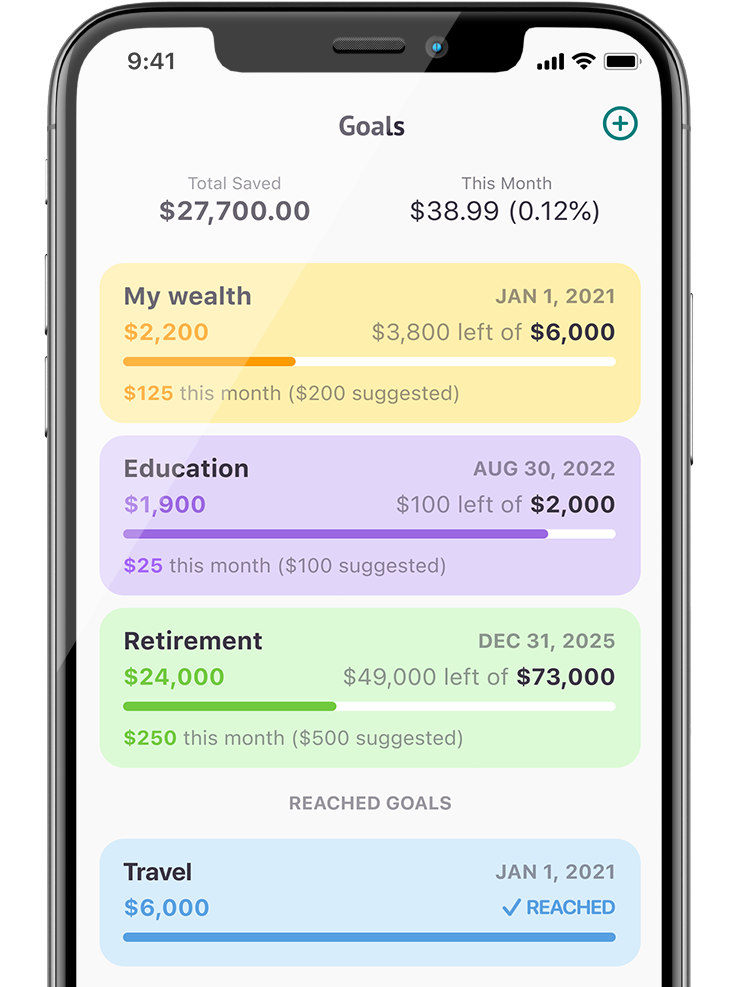

Digit

This savings app is one of the best-known in the genre. It’s pretty straight-forward: you connect it to your bank accounts, it analyzes your income, spending, and bills, and looks for money it expects you won’t be needing in the near future, which it then transfers to its own Digit savings account. The account doesn’t earn interest, but they do pay you a small “savings bonus” every few months. It also comes with a chatbot, savings goals, and other tools to help you with your finances.

Cleo

Cleo is a financial advice AI, not a banking app. Its main purpose is to help you understand more about your finances and help you save money where you can. You can link it up to your bank accounts (read-only, for security), ask it questions in Facebook messenger, and also have it transfer money you want to save into a Cleo wallet. The whole goal is to make your finances friendlier and help you look at all your financial data in one place using AI to analyze your financial situation and identify savings opportunities.

Charlie

Charlie is a penguin, but he’s unusually good at managing finances for a flightless Antarctic bird. He analyzes your accounts, identifies ways you could save, helps you meet financial goals, cuts unnecessary expenses, alerts you to fees and unusual spending, and more. His secret is that he’s actually an AI that you can chat with through Facebook messenger and SMS. Just connect him to your bank-accounts (read-only access, don’t worry!) and the AI will analyze your spending patterns and transactions and come back with a plan for you. He even learns what kind of advice is most helpful for you and focuses on that. He doesn’t move your money around for you, but he’s completely free to use.

Other interesting apps using AI or algorithms to help you save include: