Financial advising and portfolio management used to be services reserved for the relatively well-off, but thanks to Robo-advisors, that’s no longer the case. Algorithms have proven to be a very reliable way to set up and manage simple investment accounts, building low-cost portfolios that provide very reasonable returns without requiring large initial investments or charging high management fees.

As if that wasn’t enough they also tend to be very user-friendly, providing access and management options through websites and apps and making the sign-up process very simple for new investors. Even with the increasing incorporation of AI, though, they are still relatively basic investing tools, best for people looking for basic long-term portfolio options.

What is a Robo-advisor?

Robo-advisor is actually a very general term—it doesn’t refer to one single technology or service. Some Robo-advisors just give you helpful investing advice and leave the actual investing to you, while others will handle literally everything about your portfolio for you. At the core of every Robo-advisor, though, is an algorithm that takes information about a customer as input and returns recommendations about how that customer’s money could be best invested. Automating this process makes managing small-scale customers a lot more efficient, as humans have to do a lot less work per account.

Typically, the process followed by a robo-advisor looks like this:

- When a customer signs up, gather data about their savings goals, time horizons, and financial situation.

- Use this data to recommend a portfolio (usually pre-built) that is close to their needs.

- Whenever the customer deposits money into their account, invest it according to the set investment strategy and portfolio situation.

- Periodically check the customer’s portfolio and rebalance it if necessary.

- Implement tax-loss harvesting and other optimization strategies as needed.

Types of robo-advisors

The Robo-advisors you’ve heard of are probably “full-service” Robo-advisors—algorithms that automatically handle investing your money, optimizing your portfolio, and rebalancing regularly. There are other types, though, that comes with more of a human element. Deloitte offers a helpful scale to measure this, running from 1.0 to 4.0.

- Robo-Advisor 1.0: While they’ll probably include questionnaires and robots dispensing investment advise, that’s pretty much it. You’ll have to set up your own accounts and make your own investments.

- Robo-Advisor 2.0: Here, robots are primarily in charge of making trades and implementing strategies set by human managers. They may sort customers into preset portfolios based on their risk profiles, but their human overlords are the primary decision-makers.

- Robo-Advisor 3.0: This is probably the most common type since it’s the most convenient and public-facing. It’s essentially an algorithmic wealth manager that makes investment decisions and implements them for you automatically, guided by preset investment rules and possibly by data drawn from markets. Human managers provide high-level oversight, but very little hands-on adjustments in day-to-day trading.

- Robo-Advisor 4.0: This AI-based Robo-advisor is what 3.0 is currently advancing towards, and is likely to be the most common type in the future. Under this system, the Robo-advisor will be responsible for pretty much every part of a portfolio, using data about the customer and market conditions to make decisions and improving itself by using self-learning algorithms. With the ability to learn from customer behavior and market data, these Robo-advisors will be able to manage money much more efficiently.

If you’re unsure which type fits you best, there are plenty of sites and tools that can help you figure out how to best pursue your investing goals, including chatbots like Finmatex, which interact with you directly to recommend relevant banks and products.

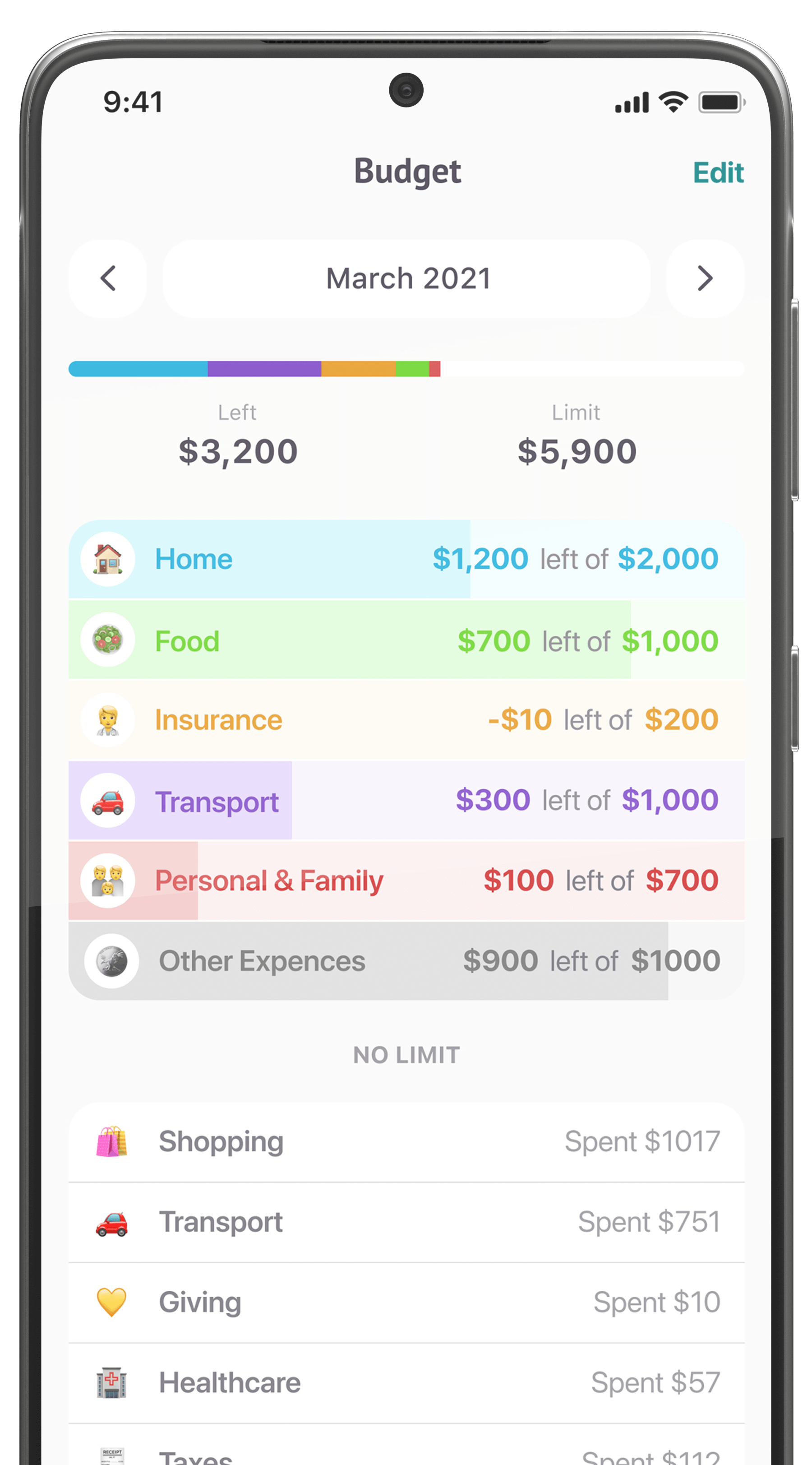

What can Robo-advisors do for you?

Robo-advisors tend to offer a relatively limited range of products, which helps them keep their costs down. Though their offerings are expanding, most Robo-advisors have the basic IRA/Roth IRA option for retirement accounts and taxable brokerage accounts for general investing. If you’re looking for something more specific, like a 529 education savings account, your choice of Robo-advisors will be more limited.

Since they’re focused on keeping your investments simple low-cost, most Robo-advisors invest heavily in ETFs and index funds. These have low annual costs and automatically spread your investments over many different companies in multiple sectors. The specific investments will vary depending on the Robo-advisor and the investor’s risk profile, but the most common Robo-advisor portfolio by far is a diversified mix of stocks and bonds.

Most Robo-advisors use Modern Portfolio Theory to manage your investments, meaning that each investment decision is evaluated on the basis of how it will affect the risk in your portfolio. They look at both the average expected returns generated by each investment and the standard deviation of those returns, which is a measure of risk. They try to keep your portfolio at maximum efficiency by maximizing expected returns and minimizing risk.

One of the most helpful things about Robo-advisors, though, is that they rebalance your portfolio and find tax advantages for you. Human investors might rebalance a few times a year at best, but some Robo-advisors will check your portfolio as often as once a day to see if your risk is still at the desired level and readjust if it’s not. The average human investor probably isn’t familiar with tax-loss harvesting, but Robo-advisors can automatically figure out when to sell your losing stocks and reduce your taxable gains. Essentially, Robo-advisors can probably manage your money better than you can.

What should you look for in a Robo-advisor?

More and more companies are getting into the Robo-advising game, so there’s no shortage of options for Robo-advisors at every level of cost and service.

Service fees and expense ratios

This question isn’t as simple as it looks. Every Robo-advisor tells you up-front that it will charge you a service fee, usually a percentage of your assets or a flat fee. However, you’ll also be paying the expense ratios (fees) on the investments picked by the Robo-advisor. Robo-advisors generally choose low-cost investments, but it’s worth checking to make sure that your money won’t be going into a pricy mutual fund. Some advisors waive their service fees for the first few thousand dollars you deposit, and some may give you a trial period before they start charging, but these won’t include expense ratios on investments.

Minimum deposit

Like traditional advisors, Robo-advisors need your account to be worth their time and effort, so many of them only let you open an account with a minimum deposit. These typically range from several hundred to several thousand dollars, though several Robo-advisors have no minimum, hoping to attract younger, less-wealthy customers with higher future investment potential.

Level of automation vs human service

Do you need a human checking up on your account and giving you personal support, or would you prefer that a robot do all the work and you just check in on an app every now and then? As a rule, you’ll pay more for Robo-advisors that incorporate higher levels of customer service into their products, but this can be helpful if you have financial planning needs that go beyond a set-it-and-forget-it IRA. If you’re especially enthusiastic about the future of AI, though, you might want to find a company that emphasizes its technological edge.

Available products and investment strategies

Every Robo-advisor offers basic retirement and investment accounts, but if you have a wider range of investment needs, you’ll want to comparison shop based on who has what you’re looking for. Additionally, you have specific criteria, like socially-responsible investing or even investing for women, you’ll want to look for services tailored to your interests.

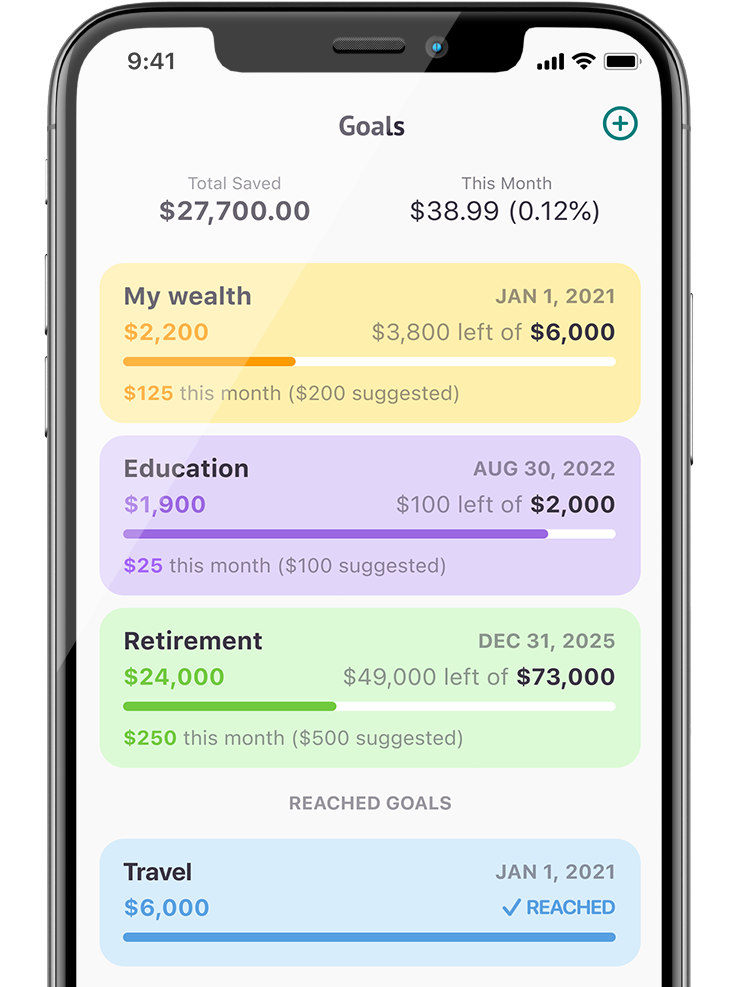

Is a Robo-advisor for you?

You should consider a Robo-advisor if you:

- Are a relatively new investor or aren’t inclined to spend a lot of time managing your investments

- Have simple investment needs

- Are looking for a low-cost investment option

- Trust machines at least as much as humans

Consider a different option if you:

- Are an experienced investor

- Have complex investment needs

- Prioritize service over cost

- Don’t trust machines

Robo-advisors are going to play a huge role in the future of investing: two of the biggest investment companies in the U.S, Vanguard and Schwab, have both started their own robo-advising services, and there’s no shortage of startups and established banks entering the space and innovating. Their low-cost products and user-friendly interfaces are ideal for younger people and investors who otherwise wouldn’t benefit from the services of a wealth manager. If you’re looking for good returns with minimal effort, robo-advisors are a great option.