A smart personal financial plan helps you stay on track of your income, spending, and short-term and long-term financial goals. Below are the important steps you can take while building a financial plan for yourself.

Add Up All Your Expenses

The very first step to building a good personal financial plan is understanding where you already are. Over the course of a month, track everything you spend and group it by category.

This can include:

- Rent or mortgage

- Utilities

- Phone plan

- Health insurance

- Medical expenses

- Car payment

- Car insurance

- Gas

- Groceries (including hygiene necessities)

- Restaurants/takeout (track this separately from groceries)

- Alcohol if you drink

- Other purchases like clothing

- Recreation

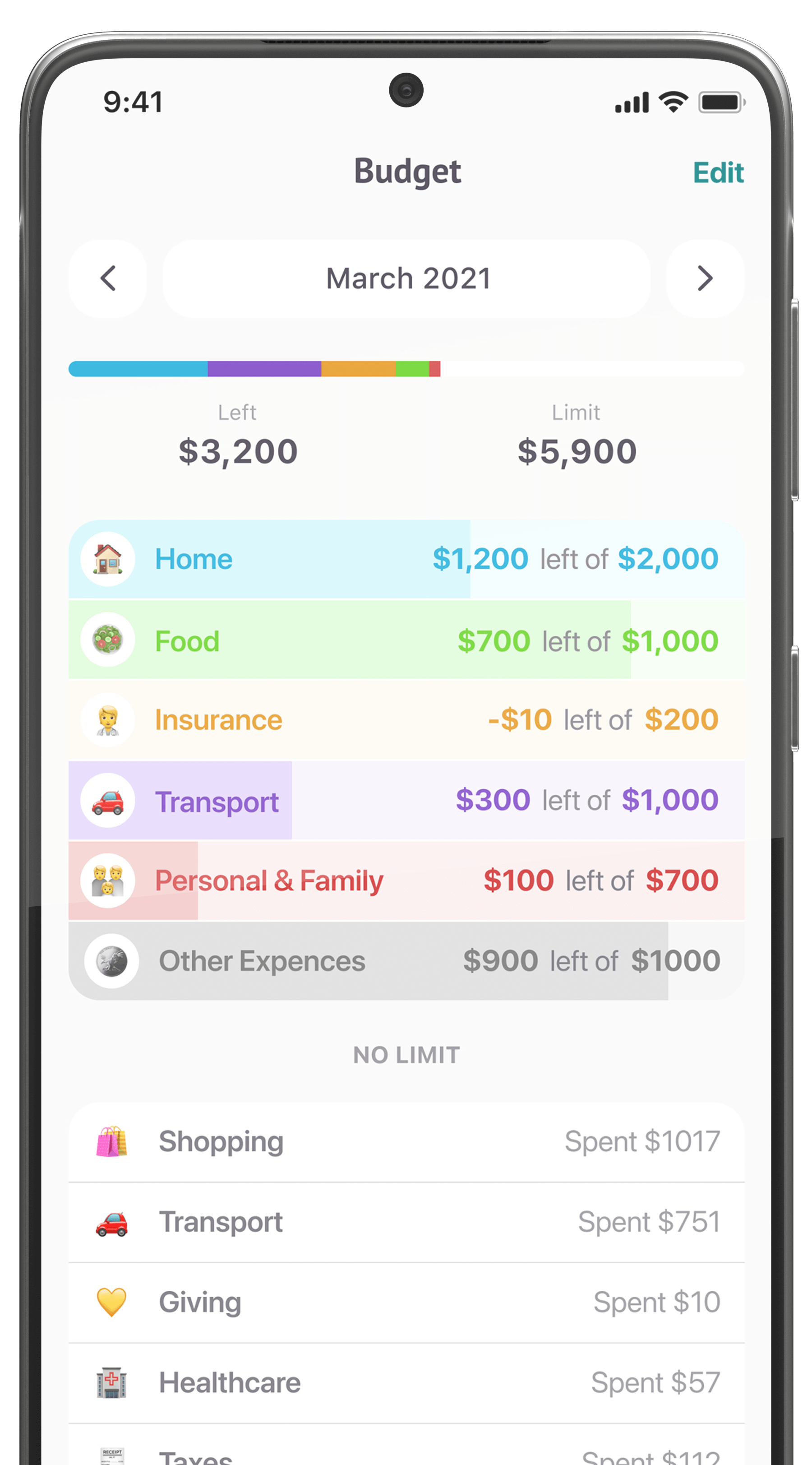

Track these however you like—with a spreadsheet, with pen and paper, or with a free app like Mint, Wally, or Clarity Money. If you use an app, it will usually automatically track what you spend on linked cards and categorize those expenses. You’ll still need to manually add things like cash purchases, but otherwise, these apps can offer near-effortless tracking with robust analytics, so they are becoming a preferred modern method.

Build a Realistic Budget

Once you’ve listed all your expenses, you can begin looking for opportunities to reduce or optimize them.

The very first thing, of course, is to confirm that your expenses don’t exceed your income. If they do, it’s a fast-track to debt. If your expenses are equivalent to your income, it means your lifestyle is “paycheck to paycheck,” which also is not financially healthy.

Next, look for any numbers that surprise you. Maybe you order Chinese food more often than you thought and your takeout expense is larger than expected or perhaps Saturday nights socializing with your friends a the local bar tend to get quickly out of control.

There are plenty of ways to reduce your expenses, as long as you’re committed. Here are a few suggestions:

- Housing → Get a roommate or settle for a smaller house or apartment.

- Utilities → Always turn off lights, take shorter showers, minimize heat and A/C use.

- Phone → Don’t chase the newest models and switch to a budget plan like Google Fi or Mint Mobile.

- Car payment → Never buy a new one because they lose value quickly.

- Gas → Drive a fuel-efficient vehicle.

- Groceries → Buy cheap staple foods like dried beans, lentils, rice, flour, frozen vegetables, etc., and start meal prepping once a week. Supplement with fresh foods as needed. Use coupons and rebate apps at the grocery store.

- Restaurants → Learn to cook your favorite meals at home.

- Alcohol → Drink less, learn to mix drinks yourself and invite friends over instead of meeting at a bar.

- Clothing → Take an inventory of what you already have to reduce impulse purchases. Sell or donate anything you don’t wear.

- Recreation → Look for free local activities, watch movies on free websites like Vudu instead of in the theater, etc.

Let’s note that a realistic budget means a budget you can stick to. If you give yourself a budget that is too tight, you might get burnt out and call it quits. Compromising to get takeout once or twice a month can work in your favor by keeping you on track.

Create an Emergency Savings Account

When you’ve cut your expenses enough to have extra money every month, priority #1 is an “emergency fund.” This is an amount you keep in your savings account so you’ll be able to handle unexpected life events such as job loss, car or house repairs, or medical bills, without needing to borrow money or cash out of investments.

Usually, it’s recommended to keep 3-6 months’ worth of expenses in this fund. You can decide how much you feel comfortable with. It’s best to keep these funds in a high-interest savings account that you never touch unless it’s an emergency. Good options include Ally Bank, Discover Bank, and Capital One 360—you can apply for and manage each of these accounts online, and they return solid interest rates. Chat with FINMATEX to decide what bank account might be best for you.

Anticipate Future Needs

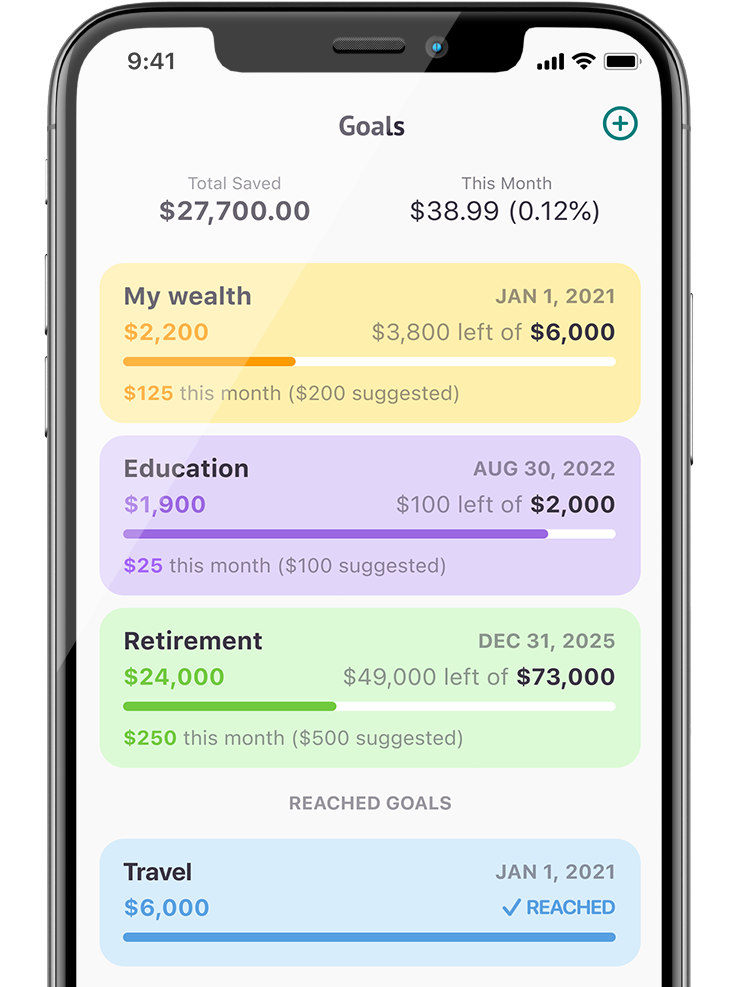

In addition to your emergency fund, you should be planning and saving for upcoming non-emergency expenses.

For instance, if you plan to buy a house within the next few years, you’ll need a downpayment. If you’re going to expand your family, account for future childcare costs. Keep track of your car’s maintenance schedule and get it serviced on time (so small repairs won’t turn into big ones).

Invest for the Long Term

While saving for short-term goals like the ones above is important, a good personal financial plan needs to factor in the long-term situation as well. That means investing for retirement!

In this case, “investing” is the keyword. Simply adding money to your savings account isn’t the best strategy. You’ll get a number of benefits by using a dedicated retirement account to invest in the stock market.

First is the tax benefits. If you use a standard 401(k) or IRA retirement account, you’ll be able to deduct contributions from your income the year you file. If you use a ROTH 401(k) or ROTH IRA, you’ll still pay taxes the year you contribute, but not when you withdraw funds in retirement. We won’t get too deeply into the pros and cons of regular vs. ROTH here, but you’ll save money on taxes either way.

The second major benefit is the growth potential. Whereas a regular savings account might pay you 1-2% interest per year, the stock market has historically returned 7%, adjusted for inflation. That doesn’t mean every year will be a great year because stocks can go down too—but if you’re truly thinking for the long term, you can just ignore these year-to-year fluctuations. The market always recovers after a crash, so resist the urge to cash out prematurely.

Diversify your investments by choosing index mutual funds and exchange-traded funds, which are collections of stocks. These are safer than choosing stocks one by one.

Adjust Your Personal Financial Plan Over Time

As your life situation changes, so will your financial plan. However, do your best to avoid “lifestyle creep” if your income increases. You don’t have to spend more just because you’re earning more. The more you save and invest over the years, the more financial freedom you have (and the sooner you can retire).

When your financial needs evolve, consult FINMATEX to choose the banking products and services that are best for you.