There isn’t just one correct way to invest: where you should put your money depends on what you’re saving for, how far in the future you need the money and the financial instruments that are available to you. Saving for a child’s education and saving for your retirement are two very different goals with different time frames, and you’ll need different tools and strategies to make the most of them. It may seem complex at first, but there are only a few types of investment accounts that most people need to worry about, and the strategies you should employ for those accounts tend to be mostly variations of the same strategy.

What type of investment accounts are there?

The vast majority of U.S investors use one of the following accounts:

- 401(k)/403(b): These are retirement accounts offered by employers. They come with tax benefits (you can deduct contributions and the growth won’t be taxed until you withdraw), and some employers will match your contributions. You can’t get one unless your company or organization offers it. These are usually good deals if you can get them, but keep in mind that early withdrawal is penalized. Contribution limits are reassessed annually, but as of 2018, you can put in $18,500 per year.

- Individual Retirement Account (IRA): Anyone can open one of these accounts with a financial institution and use it to save for retirement. You can invest in pretty much anything and enjoy tax-free growth (until you retire and withdraw your savings) with deductible contributions for the tax year you contribute, much like the 401(k). Early withdrawal is also penalized here, and you can only contribute $5,500 per year. You can’t bypass that limit with multiple IRAs—the $5,500 figure is for the sum contribution to all your IRA accounts, including Roth.

- Roth IRA/401(k): Similar to the traditional 401(k)/IRA, except you contribute with after-tax income, meaning you can’t deduct it. However, since you already paid income taxes on your contributions, any withdrawals you make in retirement will be completely tax-free. They are also more flexible in terms of early withdrawal rules and penalties than traditional accounts.

- Taxable brokerage accounts: You can get these from pretty much any financial institution, but you won’t get any tax benefits. You can’t deduct contributions or enjoy tax-free gains. These are typically only a good option if you’ve maxed out your other options (no limits here!) or require some extra flexibility.

- 529: This is probably the most popular college savings plan, and it looks a lot like a Roth IRA. You contribute with after-tax dollars and, in return, get tax-free growth and withdrawal. It can only be used for higher education expenses, though; anything else will incur a penalty. People generally use the 529 as an investment account, but there is also a variant that lets you pay a university upfront to lock in their current tuition rates, though this is getting rarer.

Most of these accounts allow you to invest in more or less anything: mutual funds, stocks, bonds, real estate, annuities, et cetera. The account simply acts as a sort of “tax shell,” protecting anything inside it from certain taxes. Some accounts come with restrictions on what you can buy, but they’re generally quite flexible.

What can I invest in?

You’re probably familiar with the stock market, but shares are only one of the things you can hold in an investment account, and you probably want to have some other instruments as well. These are some of the most popular instruments:

- Stocks: Equity in a company. Risky, best for long-term portfolios.

- Bonds: Corporate or government debt. Safe, better for short-term.

- Mutual funds/Index funds/ETFs: Instruments that follow the value of large bundles of stocks and/or bonds. Most portfolios are heavily weighted towards these since they provide automatic diversification.

- Annuities: Though they come in many different forms, these are essential instruments that you can purchase that will pay you regularly when you retire. They’re generally reserved for special cases, such as late starts on retirement savings.

- Real Estate Investment Trusts: Basically a mutual fund that owns real estate and pays you the profits (if there are profits). Can be risky, so is best handled by professionals and given a small percentage of your portfolio.

- Dividend Income Funds: Funds that own and manage dividend-paying stocks, giving you the dividends at regular intervals. Can be a steady source of income in good times, but sometimes risky.

- Commodities: You’re basically buying real goods in the hopes that they get more valuable so you can sell them for a higher price later. Can be quite risky, so commodity investments should generally be professionally managed and well-diversified.

- Cryptocurrencies: Probably the riskiest current asset class, but you can actually include it in an IRA or other investment portfolios by buying funds that track individual cryptocurrencies or bundles of cryptocurrencies. Or you can just buy them on exchanges for a more DIY experience.

These are not the only asset classes and instruments you can include in a portfolio, but they make the most sense for the average investor, as they span a wide range of assets and risk levels. Many portfolios are made up only of stocks and bonds, which is just fine for most needs.

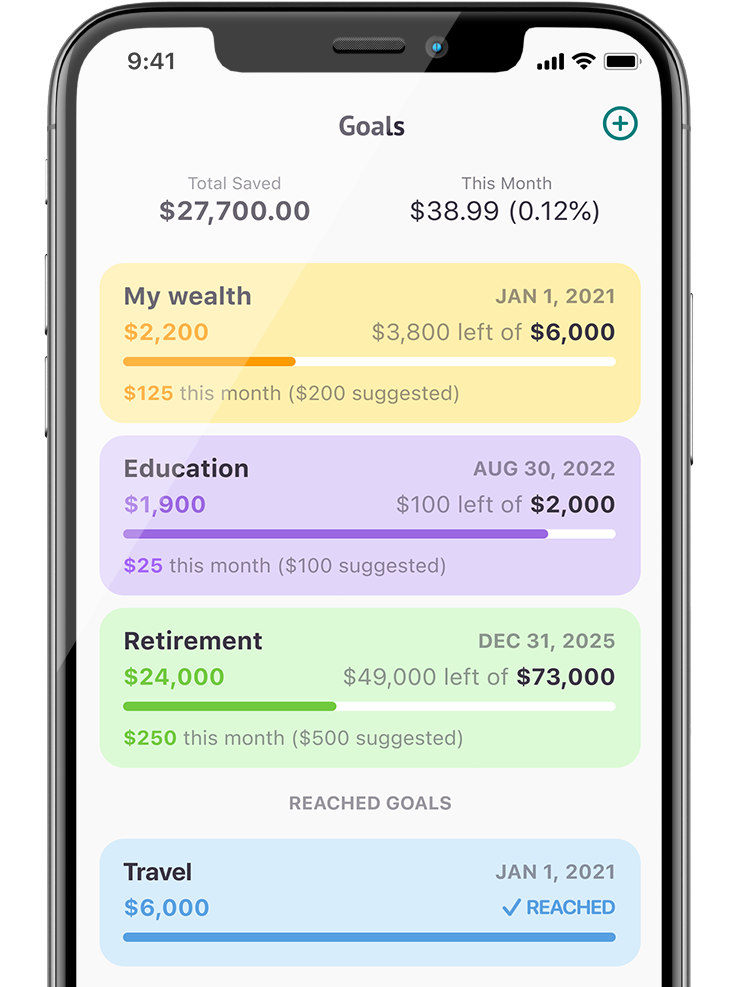

Retirement investment strategies

Investing for retirement means investing for the long term, meaning the core strategy here is to go heavy on stocks and other risky instruments in the beginning, then reallocate towards bonds and other less risky instruments as time goes by. Most of your portfolio should probably be a mix of stock and bond mutual funds and ETFs with varying risk levels since these will get you a nice, diverse portfolio without a lot of effort.

If you’re more of a hands-on investor, you should check your portfolio at least once or twice a year and rebalance, meaning you should take money from the asset classes that have outperformed the others and invest them in asset classes that are now under-represented. If this isn’t your idea of a fun afternoon, you can easily find services that will manage your portfolio for you based on the parameters you set and the risks you’re willing to take. Typically they’ll take into account your age and your desired retirement year and adjust your portfolio accordingly as time goes on. If you need help finding a good manager, whether human or Robo-advisor, financial search tools like Finmatex can help you out quite a bit.

If available, you should first contribute to any 401(k) or 403(b) accounts that have matching contributions from your employer. If that’s not in the cards for you, a Roth or traditional IRA is probably your best bet. These options should be maxed out (IRAs let you contribute $5,500/year, 401(k)’s let you contribute $18,500) before you open a taxable brokerage account.

Education investment strategies

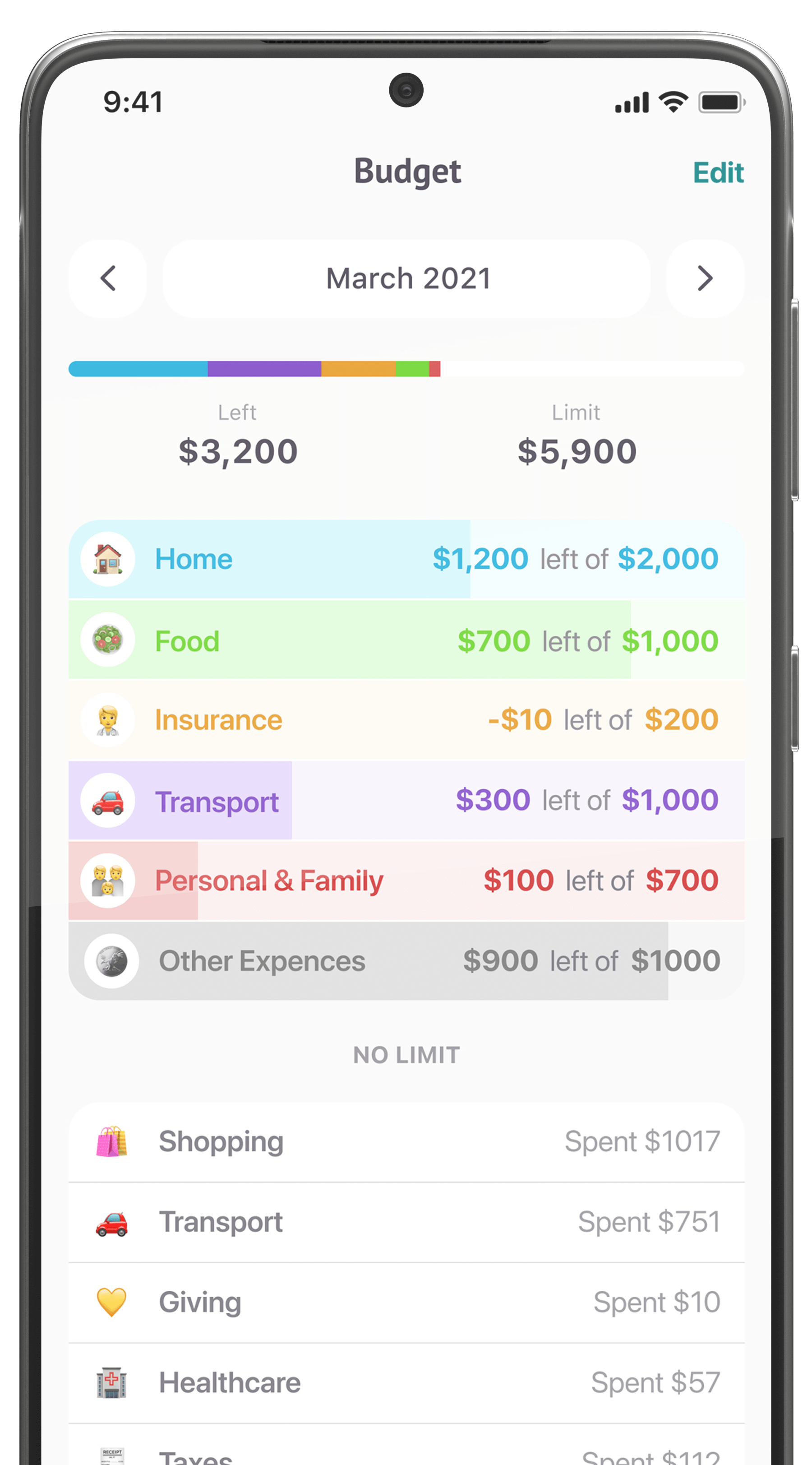

Saving for education, depending on when you start doing it, can be either a medium or short-term goal, and the general rules still apply: longer time horizon = higher risk. Don’t forget to rebalance! As you get closer to needing the funds, decrease your stock holdings and shift towards bonds.

One major difference is financial aid. If the accounts are held by the student, the money in them will count against the student’s eligibility to receive tuition benefits. Having the accounts controlled by a parent can help mitigate this issue, but it’s important to keep in mind since some accounts are owned by the children by default.

The 529, mentioned above, is the most popular education savings account, as it has a lot of tax advantages and allows you to contribute up to $14,000 per year. It’s also held by the parent, so the financial aid issues don’t pop up here. The downsides: it can only be used for higher education, it often has a more limited range of investment options, and it only rebalances twice a year.

A less-talked-about option is the Coverdell, which is far more flexible, but only lets you contribute $2,000 per year. You can use the money for any education expense, even elementary school, and can control the portfolio pretty much the way you want to. The downsides are the low contribution limit and that the child gets control of the account when they turn 18, which may impact financial aid eligibility.

You can choose to maintain these accounts by yourself, or you can use one of many services that do the allocation and rebalancing for you automatically. These all offer different advantages and can vary by state, so it’s a good idea to research your options using search tools, such as the AI-powered FINMATEX chatbot.

Other investment strategies

If you’re not saving for big expenses like retirement or education, you may still have some goals you want to meet: some extra money for vacations, a new car, a down payment on a house, et cetera. If that’s the case, you’ll want to consider your time horizon: how long will it be before you may need the money?

Very short time horizons, under two years, don’t leave you with many safe options beyond traditional savings and money market accounts—maybe CDs. If you’re looking at two to five years, you might want to look into bonds and bond-based mutual funds with suitable maturity dates. Peer-to-peer lending is also an up-and-coming market that can generate positive returns in relatively short time periods. It may even be worth looking into promotional deals offered by banks and credit cards since they can often give you immediate returns with relatively small time investment.

If you’ll be saving for more than five years, a risk-appropriate mix of stocks and bonds is a good way to go. Make sure to rebalance the allocation to reduce your risk the closer you get to your savings goal. Again, look into services and advisors that can help you with this if you don’t feel comfortable handling it yourself; you can find lots of user-friendly investment tools these days.