If checking accounts are Personal Finance 101, savings accounts are Personal Finance 102. They’re useful for a lot of reasons: they have higher interest rates than checking accounts while still being easy to open and manage, can help you save automatically using automatic transfers and other savings tools, and are even helpful for your own personal mental accounts. Having a separate account where your savings reside really does change your spending habits (though it helps that most savings accounts make it harder to access your money). The bottom line: Unless you’re not saving anything at all, you should have a savings account.

The basics

If a bank offers checking accounts, it will most likely also offer savings accounts. That doesn’t mean you should necessarily use the same bank for both; it’s best to shop around for good deals. The main differences between checking and savings are:

- Higher interest rates

- Limited withdrawals (3-6 per month)

- Limited access options (most don’t offer ATM cards/checks)

FDIC Insurance

Checking, savings, money market accounts, certificates of deposit, and other bank deposit instruments are covered by the FDIC for up to $250,000 dollars if something happens to the bank. Pretty much every bank in the U.S is covered, so you probably don’t need to worry. If the bank is small or seems like it might not be the most trustworthy, though, it’s not a bad idea to double-check.

Interest rates

Interest rates change all the time, so it’s always important to do some initial research to figure out what you should be looking for. In lean times, interest rates can be below 1%, not even enough to compensate for inflation, while in good times you can easily get a few percentage points higher. The best way to find out what you should be looking for is to use some comparison tools, such as Bankrate or Finmatex, which will give you a good idea of what the best current offers are.

In general, you should go with the highest interest rate you can reasonably get. The point of savings accounts is to save money, and the best way to do that is to find one that returns well. Online banks generally have the highest rates, as they don’t have much physical overhead to maintain. Local banks and credit unions, which are often non-profits, can also provide high-interest rates, though they may come with some limitations and probably less-developed online/web interfaces. Traditional banks with brick-and-mortar locations generally pay the least.

No fees or fees you can easily avoid

A lot of banks, especially more traditional ones, will charge you monthly account maintenance fees. If you have a low-interest rate and/or a low balance, this can lead to your savings account actually costing you money, which is the opposite of what you want. The easiest way to make sure you don’t run into issues with fees is to choose accounts that don’t charge them. In many cases, these fees can be avoided by maintaining a minimum account balance ranging from several hundred to several thousand dollars. If you’re confident that your balance will remain steadily above the minimum, you’re probably safe; just be aware of the costs that fees can incur.

Promotions

Especially when interest rates are low, promotions can be extremely lucrative. Some banks offer high introductory interest rates for the first year or so, which can be worth it as long as you’re confident that you can move your money to a higher-earning account after the promotional period is over and the rates drop.

Sign-up bonuses can also be a surprisingly good option. Many savings accounts will offer bonuses of up to several hundred dollars just for opening the account and making some deposits (often direct deposits from an employer) or meeting a minimum balance requirement. Depending on the offer and its terms (read the fine print!) these promotional bonuses can be quite lucrative—perhaps more so than several years of interest would otherwise be.

Access options

It’s called a savings account for a reason—it’s not for spending. Still, there are times when you need quick access to some cash and you just don’t have it in checking. If you have savings and checking with the same bank, you can usually make an online transfer quite quickly; otherwise, it may take several days.

If you think you’ll need access to savings on a semi-regular basis, you are allowed to make 3-6 withdrawals a month (depending on the account) without penalty. After that, you may find yourself being charged a fee. Make a habit of going over the limit, and you’ll probably find your interest account closed and converted to checking.

That said, some savings accounts do offer cards and ATM access, so if access is potentially a priority for you, you may want to look for an account with these features.

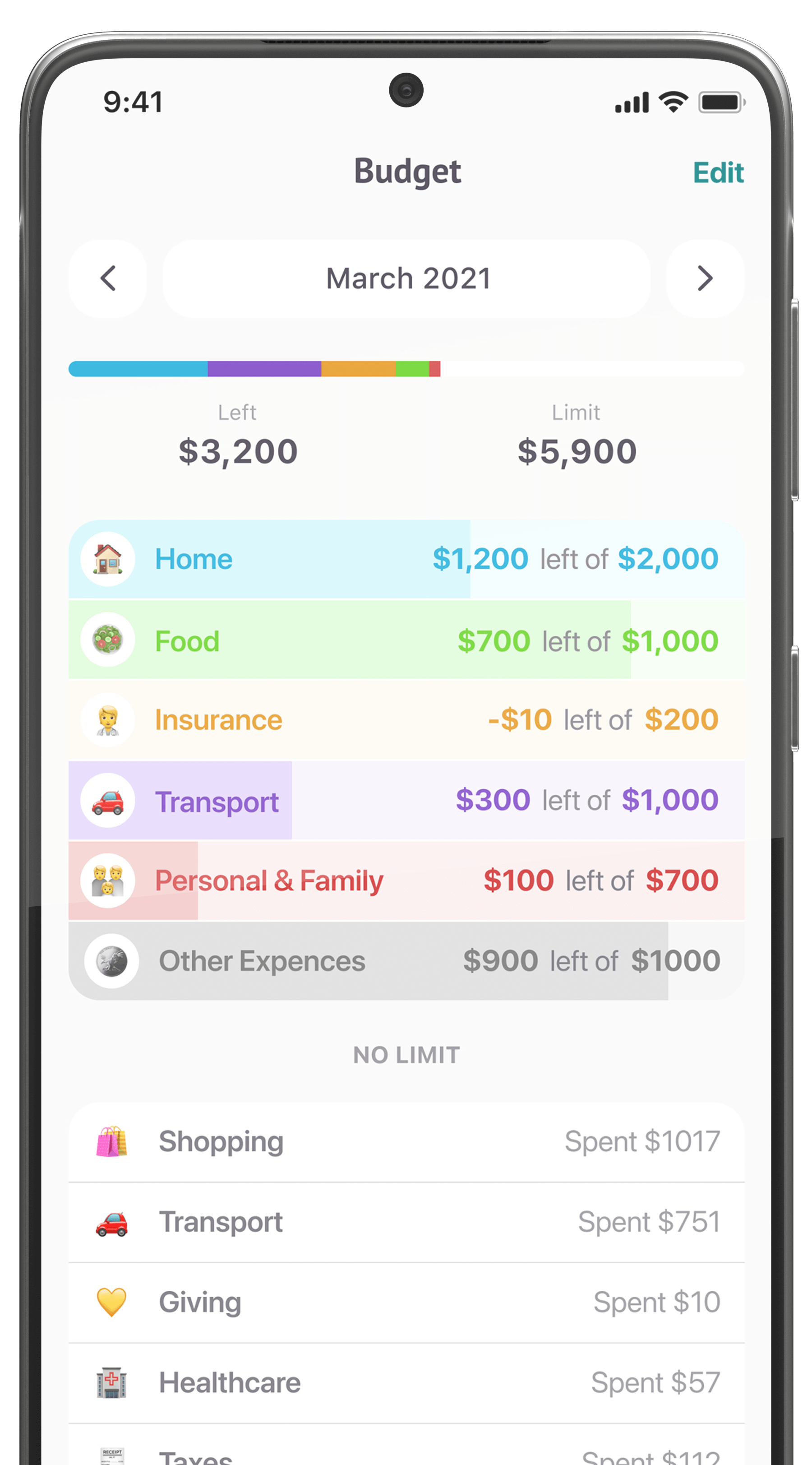

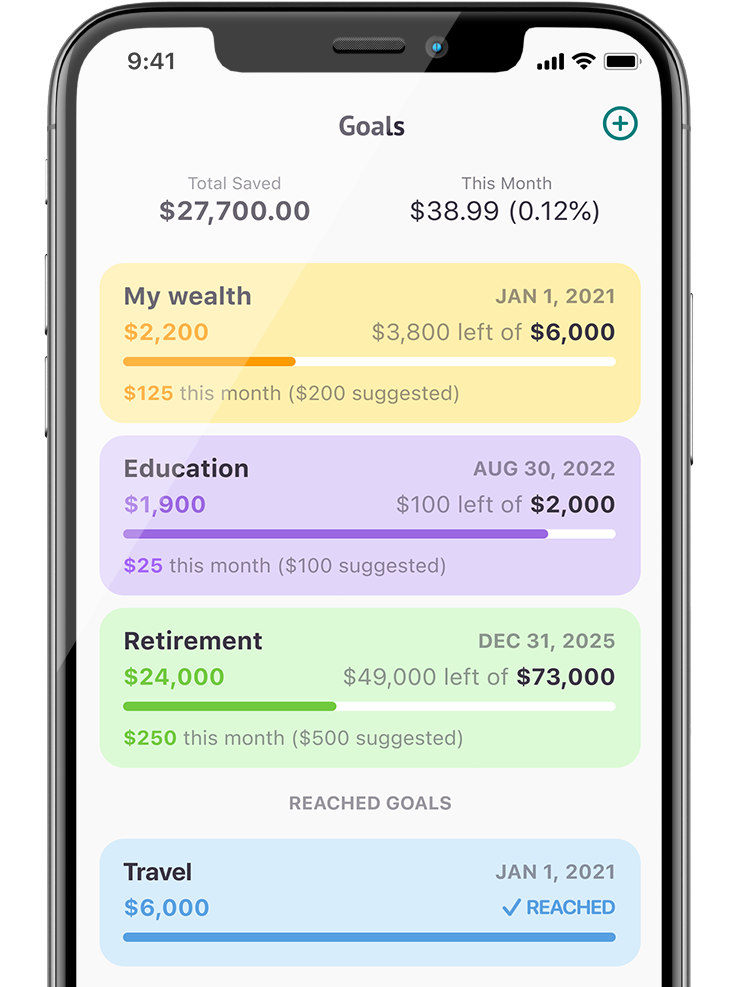

Savings tools

One of the most important factors in saving money is just putting some of it away on a regular basis. Being able to set up automatic transfers, see savings data, and save towards multiple goals can be extremely helpful if you have trouble putting money away or you have a specific target you need to meet. You probably shouldn’t prioritize this above interest rates and low fees, but these tools can be a great plus.

What to watch out for

Temporary/promotional interest rates

Yes, you can get excellent interest rates for a year or so by taking advantage of introductory rates offered by some banks, but keep in mind that there’s an expiration date on these. You can take advantage of them—just be sure to set up reminders for yourself to move the money somewhere more lucrative when the time comes.

Also, watch out for banks that jack up their interest rates for a few months to get new customers, then drop them again without warning. Again, this can be good for you, but keep tabs on your account so you can move your money.

Fine print

It’s not anyone’s favorite thing to do, but it’s important that you read the fine print, especially if you’re looking at a savings account with some sort of promotion or any sort of fee schedule. Be sure you understand the fees you may incur, if any, and keep a special eye on the exact conditions you need to meet to get a sign-up bonus or promotional rate. Common issues include:

- Needing a certain amount of direct deposits or certain dollar value of direct deposits to qualify for a sign-up bonus

- Needing to meet a minimum balance to get the promotional interest rate

- Only getting the promotional interest rate on part of your deposit (e.g: 3% on the first $1000, 1% on anything above that)

Other options

Savings accounts are a good, flexible way to earn a little more with your money and meet savings goals. For longer-term savings, albeit with less flexibility, you may want to look into a certificate of deposit (CD), which essentially “locks” your money away for a set amount of time, but pays you higher interest.

If you anticipate needing to spend more, look into a money market account (MMA), which offers you more access options (check-writing/ATMs) and gives you good interest rates: it’s like combination savings/checking account. You often have to make a higher opening deposit, though, and depending on the bank, the interest rate on the MMA may be lower than a savings account elsewhere.