Technically, a magic 8-ball counts as a chatbot. You give it some input by asking it a question (that it doesn’t hear) and activating it (with a physical shake), and it returns a probably-unhelpful random response. If banks used magic 8-balls for any significant work at all, though, things probably wouldn’t end well.

Modern chatbots, though, are being increasingly deployed in banking roles ranging from sales to contract analysis, and generally doing quite well, thus proving their superiority to billiards-derived divination devices. We asked several experts what roles they could see chatbots filling in banks, and here’s what they told us.

Banking chatbots in customer-facing roles

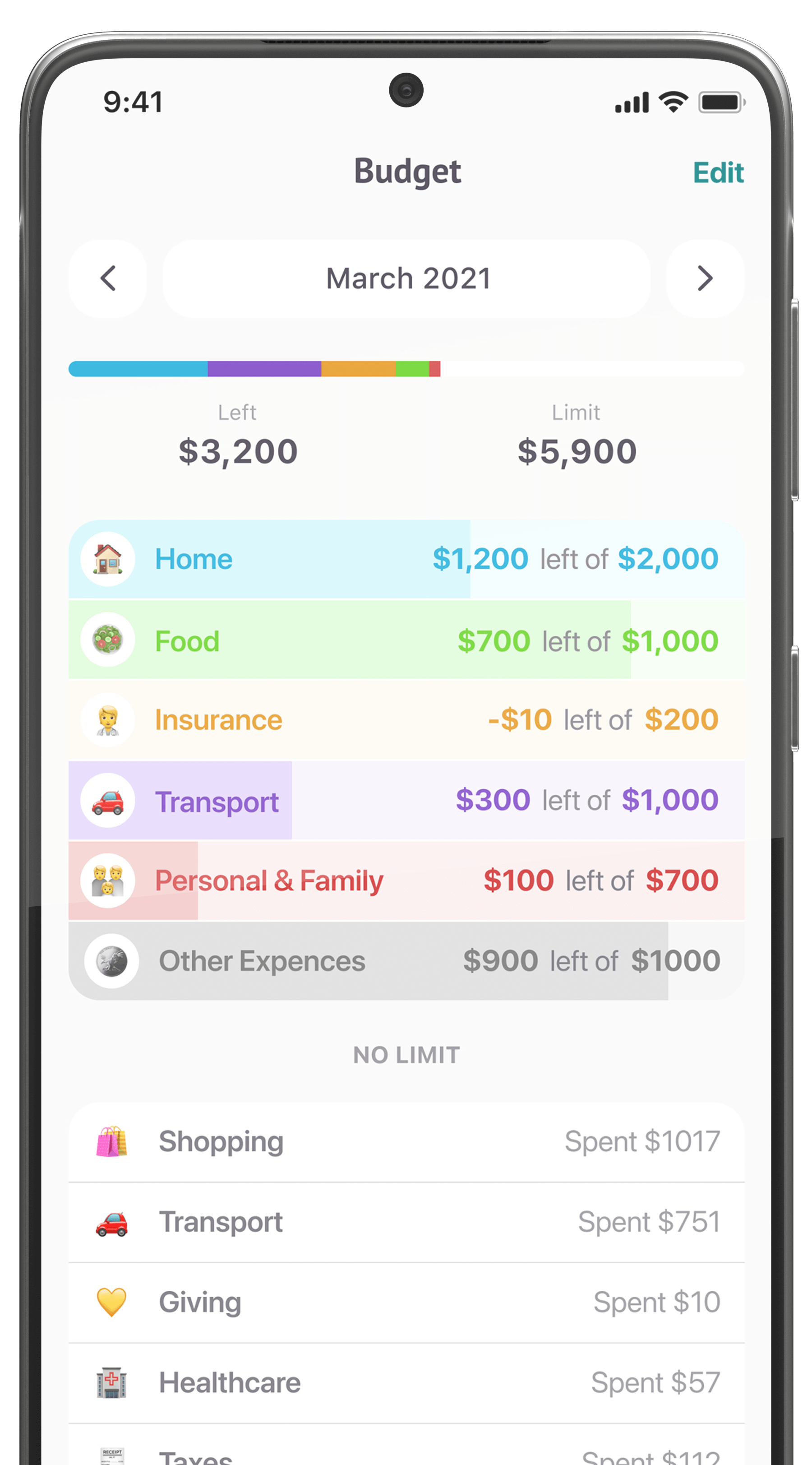

Financial services can be complex and hard to navigate, so having information and support readily available is vital for any institution. Monica Hovsepian observes that digital channels are typically the easiest way for people to resolve their issues: “Many customers prefer not to go to the branch. At times customers don’t have the time to navigate through the website trying to find answers. Many do not want to speak with an agent if they do not have to. For these customers, chatbots are a great resource.”

The numbers support her observation. According to Harvard Business Review, 81% of customers across all industries at least try to find solutions on their own before contacting support, and American Express reports that 63% of U.S consumers prefer using digital tools like websites, apps, and chatbots to solve simple inquiries. Hovsepian cites a study by Humley, an AI vendor, “that stated that 43% of digital banking customers preferred to use a chatbot to address an issue with their bank (compared with 35% preferring a branch visit and 64% preferring a phone call).”

There can also be significant time savings on the bank’s side: LogMeIn reports that customer service agents across industries spend 25% of their call time finding information about their customers and 33% identifying the customer’s need. Especially in financial services, where verification requirements can drag out calls, using a chatbot to triage issues and gather information could significantly streamline operations.

Bots can also be used to more effectively gather feedback after interactions are complete, both by directly asking users to provide input on their experience and by using tools like sentiment analysis on the content of their conversation.

Marketing and sales

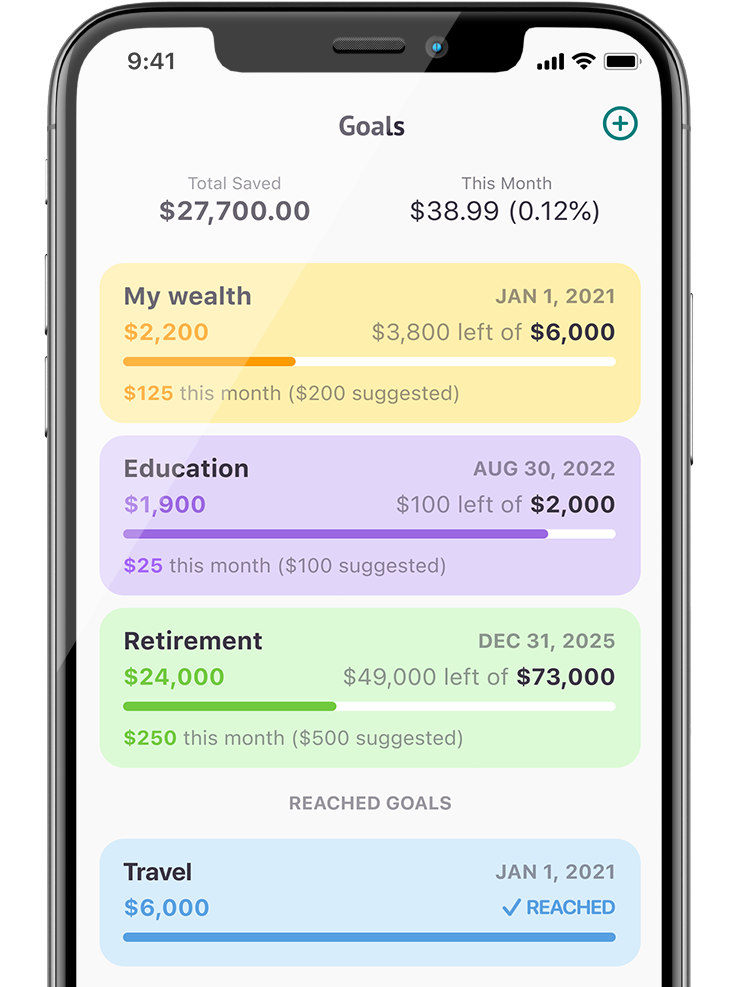

“Digital and omnichannel strategies are a must for the bank of the future,” says Germain Bahri, “and chatbots will be one of them.” 91% of respondents to LogMeIn’s survey reported that they wanted to increase customer engagement, and conversational interfaces are one of the most promising ways to do that.

Chatbots from banks like Bank of America, Capital One, Wells Fargo, and HDFC have been implemented across a wide variety of channels, from websites to third-party messenger apps. All of them, though, have the same goal: being an accessible, familiar interface that can draw people into interactions—and possibly more. “Some chatbots can be integrated as early as on the landing page of a bank,” says Bahri, “where the bot can not only answer general questions about the bank’s products and make some initial recommendations but also allow customers to take some direct actions (i.e. opening accounts, applying for loans, etc.) directly within the bot.”

Integrating analytics can also help increase customer loyalty and boost sales. Hovsepian says that “If designed and implemented properly chatbots can help provide customers personalized recommendations and offers. This can be a powerful addition to traditional website experience, increasing the interactivity, and helping augment a digital-first customer journey.”

For example, a customer that asks about international fees on card transactions or puts a travel notification on their account might want to see offers for travel-oriented credit cards, which a chatbot could mention. Anticipating user needs and wants and offering them in a highly visible communications channel is one of the biggest use cases for bots.

Humans tend to anthropomorphize machines very easily. Even ELIZA, a very simple bot developed in the 1960s, quickly gained users’ confidence. Especially with a bit of personality, bots can help build customer loyalty and make them feel more connected.

Banking chatbots in business-facing roles

The majority of chatbots are oriented towards customers, but they have attributes that can also be highly useful for users on the business side.

Modern banking systems are complex, data-heavy, and constantly changing, making disseminating up-to-date information a priority. Chatbots, as Bahri says, “can help intelligently deflect bad experiences but, more importantly, get the right answer quickly to those inside an organization, which is effectively a quick and effective cost-saver. This, in turn, reduces some of the frustrations of a cultural shift.”

A Nintex survey from 2018 found that 49% of polled employees across industries had trouble locating documents and 55% felt that their onboarding didn’t give them access to necessary tools and documents. A 2012 McKinsey report estimated that workers were spending 1.8 hours a day searching for information, and while not all of that is avoidable, streamlining the process of accessing centrally-indexed information could cut down on wasted time significantly. Using chatbots as a way to do that is still a fairly new idea, however, and will require testing and refinement.

Complementing employees

In back-office operations, chatbots are best viewed as automation tools that employees can use to expedite basic tasks like data entry, scheduling, or gathering information on support cases. Rik Coeckelbergs believes that “If it is well implemented, they [chatbots] could automate quite a few jobs that do not create a lot of value for banks and employees. Banks will be able to not only improve service to their customers but also to look for more value-added jobs for their employees that before were simply answering repetitive questions.”

Chatbots function best in a hybrid labor model, where human workers can use the technology to improve their workflow. As with AI in general, chatbots are best at automating repetitive, consistent tasks, leaving humans free to deal with more abstract problems that may require a wide range of interactions and qualitative inputs.

What do banking chatbots look like?

Currently, most banking chatbots respond to customer queries for information and perform basic account management tasks, but some, like JPMorgan Chase’s COIN, has already moved into the back office, performing tasks like contract analysis, system access control, and password resets. As bots become a more accepted part of marketing and support, it will likely be a lot more common to see them onboarding both customers and employees, providing knowledge base search functions, and taking on larger roles in the support and day-to-day operations.