2020 has had its share of clouds, with the global COVID-19 pandemic hitting people and economies hard. It hasn’t been entirely without silver linings, however, one of which is that fintech has been growing far faster than anyone would have predicted pre-COVID.

73% of Americans, for example, now believe fintech is the new normal, saying that they’ll probably stick with managing their money digitally after the pandemic. Likewise, in Europe, fintech app usage has gone up 72% since the pandemic started. This pattern holds across most of the world, with The World Bank reporting stronger international growth for fintech in 2020 than in 2019, particularly in the Middle East and North Africa.

What does all this mean for 2021? Despite the hope that there might be a relative return to normalcy by the end of the year, the surge in demand for digital financial services is unlikely to recede, and as companies continue to pivot towards remote operations, the need for more and better technologies will probably push innovation and modernization efforts forward faster than pre-pandemic projections would have suggested.

The major trends will remain roughly the same—digital banking, AI, blockchain, et cetera—but users and banks alike will adopt and adapt to these technologies at a higher rate as they seek to minimize physical contact while maintaining a high standard of service.

Digital-only Financial Services

According to a Discover survey, 44% of banking customers were banking through their primary bank’s mobile app more often in September 2020 than they were pre-COVID. This number doesn’t tell the whole story, of course, but it is indicative of how the digital transition has been accelerated in the past year, as well as the importance of mobile. Bill Genovese, CTO at Home Goldings, believes mobile is fundamental to any modern enterprise. “I don’t know how a company in 2020 can say we have a robust digital transformation strategy if they’re not mobile-first,” he says.

The basic framework for high-quality online and mobile banking has already been established, so the fundamentals are unlikely to change dramatically. Rather, 2021 is going to be about improvements, especially when it comes to customer experiences. Deloitte notes that the U.S, Canada, and Australia have all seen decreases in customer satisfaction as digital banking has increased, suggesting that customers are using digital channels because they have to, not because they prefer to.

Thus, offering more features, better support, and smoother interfaces is likely to be a priority for the next year. Towards that end, collaborations between banks and tech companies, such as the joint Citibank-Google Plex account (to be accessible from within the Google Pay app) are likely to continue appearing.

Regardless of how the improvements come, though, it’s quickly becoming essential that banks offer strong online experiences. As Paul McAdam, senior director of banking intelligence at J.D. Power, says of 2020’s U.S Retail Banking Advice Satisfaction study, “It is safe to say we’ve reached the tipping point, where banks that get their digital formulas right are seeing strong gains in both adoption of and satisfaction with advice and guidance delivered via digital channels. Within the next year, digital will surpass the branch as the most commonly used retail banking customer advice channel.”

Contactless Payments

US contactless payments were trending upwards slowly pre-pandemic (only 0.32% of transactions were contactless in 2016 and that really hadn’t risen by 2018), but as handling cash and engaging in close in-person transactions fell out of favor, those numbers shot up. 51% of US consumers were using some form of contactless payment on April 29, 2020, according to Mastercard—and that number shot up to 79% worldwide.

Contactless payments are up 30% in Europe, bringing them to 78% of total transactions, suggesting a new normal for that continent. In the U.S, the total percentage isn’t clear, but Visa reports that 25 million Americans used a Visa card contactlessly in March 2020—a 150% increase since March 2019.

Given that 74% of respondents to Mastercard’s survey said they would continue using contactless after the pandemic, 2021 is likely to see a lot more card issuers and retailers providing customers with their preferred payment method. There are already 175 million contactless cards in the US, and 9 out of the top 10 issuers are upgrading their card technology.

Retailers saw 69% more contactless transactions, and 94% expect that this trend will hold through 2021, so, combined with card issuer activity and consumer preference trends, it’s highly likely that 2021 will be the year that contactless is normalized as a physical payment method in the U.S. markets.

Blockchain, Cryptocurrency, and DeFi

Crypto has been riding up and down the hype cycle since Bitcoin was invented, but as of 2020, it seems to be coming down to earth a bit as real-world applications begin to take shape. One of the biggest winners here is decentralized finance (DeFi), which skyrocketed from a market cap of $700 million in January 2020 to $15 billion in December 2020 and is likely to continue the upward trend.

P2P lending, stablecoins, and decentralized exchanges have driven a lot of this growth, driving more stable returns, lower costs and applications that actually look like viable competitors to traditional finance. It’s still risky, but projects like Uniswap, Yearn.finance, Chainlink, Compound, and MakerDAO/DAI are making significant strides towards reliability in a historically uncertain market.

That said, DeFi is still largely separate from traditional finance, and, like many other crypto-based projects, will probably have to mature on its own before seeing mainstream adoption.

Cryptocurrency as an investment instrument and electronic payment medium, though, is likely to see a lot more activity in 2021. Bitcoin rose to near-record highs with a 170% gain in 2020, and Ethereum saw a massive 300% increase, largely thanks to its involvement in DeFi offerings.

Institutional interest is also maturing, however: Facebook is launching Libra, PayPal will have Bitcoin support, and we may see progress from other companies that have voiced crypto support, like JP Morgan, Mastercard, Visa, and others. With crypto getting easier to buy and use, there’s likely to be a 2021 uptick in mainstream adoption as an investment vehicle—and, potentially, even as a hedge against possible US dollar inflation.

Crypto companies are also starting to move into traditional finance, the most notable being the cryptocurrency exchange Kraken, which received a banking license from the state of Wyoming in September, making it the first official crypto bank in the US—though not the only one, as Avanti Bank was approved several months later. Both plan to launch in 2021, and, if they are successful, will likely inspire more crypto institutions to move towards traditional finance.

China’s digital renminbi, slated for a possible 2021 release, represents one of the first real central bank digital currencies (CDBC), but probably not the only one. Other countries are likely to follow their lead if China’s launch is a success, as the already-attractive lower costs of issuing and transacting in digital currency have been joined by the COVID-driven jump towards low-cash societies. The U.S. has been exploring a digital dollar for some time now, as have countries like Sweden, Japan, Canada, Switzerland, et al.

Artificial Intelligence and Machine Learning

AI and ML have been some of the biggest buzzwords in fintech for years now, and 2021 will be no different. According to an Accenture survey of 670 banking executives, 60% of respondents say their bank plans to invest in AI in the next year, and 79% believe that solutions for integrating technology with the human side of things need to be reworked. This lines up well with McKinsey’s numbers, which show that 60% of financial services firms have already deployed at least one AI system.

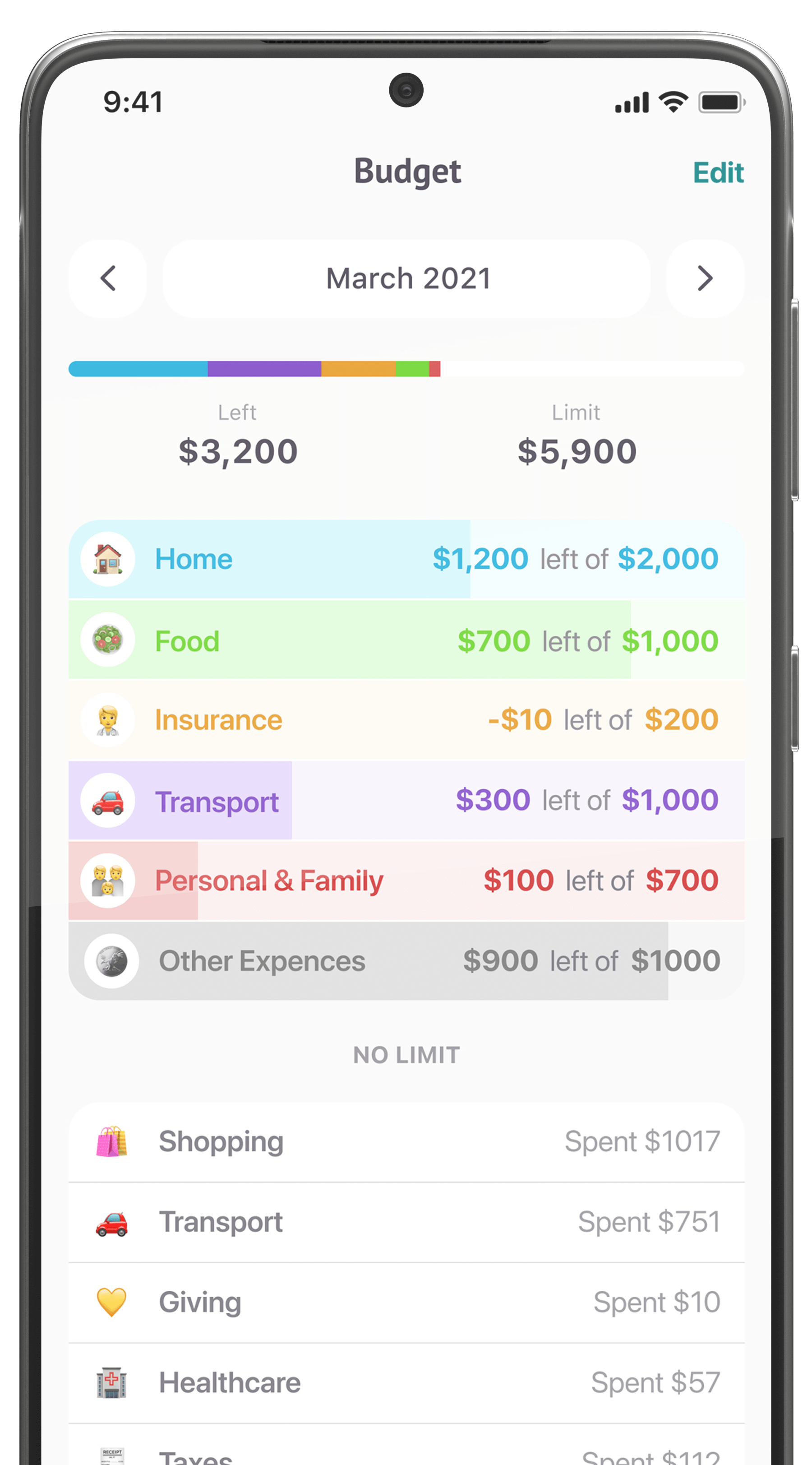

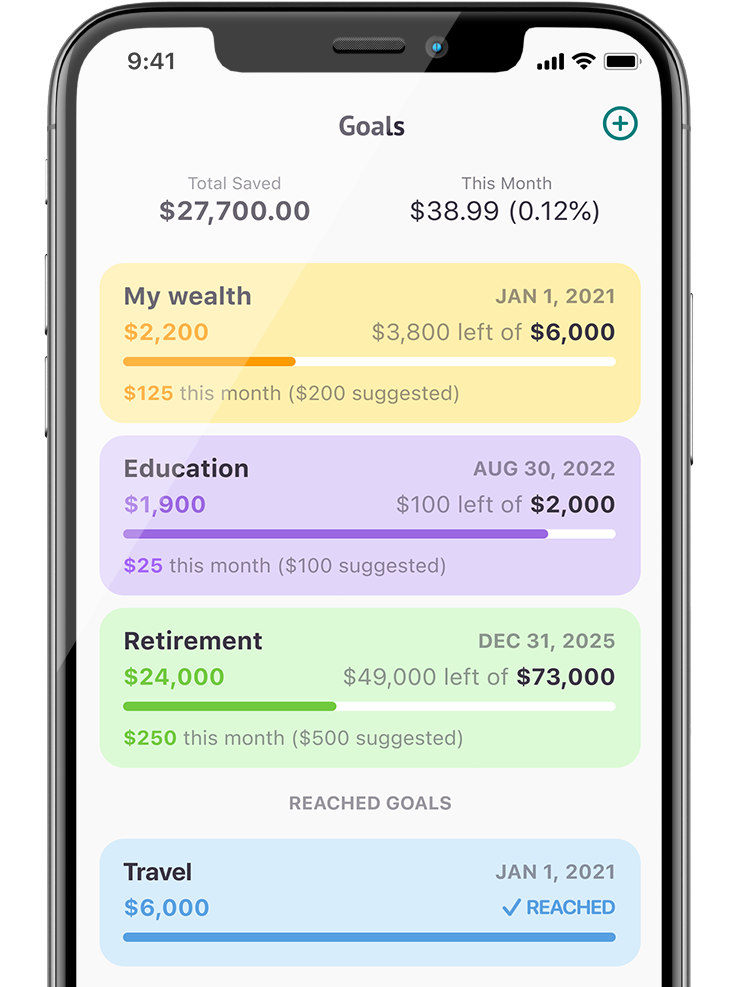

One of the biggest advances is likely to be in personalization for digital banking and other financial services, driven by the need for better online customer experiences in a world where physical operations are likely to remain at lower levels than they were pre-COVID. As Deloitte puts it, banks need to focus on “hyper-personalized services that can factor in a customer’s financial well-being holistically,” which is a big data problem that AI is very well-suited to fix.

Using customer data to power better interactions is something that banks have already been working on, and 2021 will see AI’s being able to access more data and produce better results. AI-powered chatbots will allow for faster, more helpful support, as well as providing an alternative way to get account insights and manage money. User interfaces drawing on customer data analyses will provide insights and recommendations tailored directly to the user, allowing easy access to information and functions that might have previously required a branch visit or phone call.

Other AI trends will likely continue developing as they have been for the last several years, improving both the front-end and back-end efficiency of areas like fraud detection, loan decisions, wealth management, risk management, and other data-heavy processes. The raw power contained in advancements like OpenAI’s GPT-3 and Google’s Duplex likely foreshadow some significant technical progress to come, but how much of this will make it into Fintech by the end of 2021 is uncertain.

Upgrading and Integrating Fintech into Legacy Systems

Technology moves faster than finance, and that’s become very clear during the COVID-19 pandemic. Almost 80% of respondents to Deloitte’s survey of 200 global banking executives agreed that the crisis revealed issues with their institution’s digital side. Some tech-forward banks have been pushing through big changes, but the financial world is littered with outdated core systems and fragmented databases that aren’t ready to interface with modern financial technologies. 2020 was a wake-up call, and 2021 is likely to see modernization moving faster than it otherwise would have.

Companies that started 2020 with a modern tech stack have unquestionably had an advantage, though. As Genovese puts it, “2020 has shown us those companies that have digitally transformed already are really kicking butt. The Amazons of the world, the Ubers—these companies are already platform giants, and this was like the top of the wave to them coming into 2020. They’re just cleaning up because they’re already providing that 24/7 service to consumer expectations.”

However, as Deloitte points out, there’s still hope for the less well-equipped: “While institutions that made strategic investments in technology came out stronger, laggards may still be able to leapfrog competitors if they take swift action to accelerate tech modernization.”

Exactly how this will look will vary by bank, but there will likely be movements towards cloud infrastructure, APIs, microservices, blockchain-based ledger systems, and other technologies that can make banking flexible and scalable in the way that modern tech companies already are.

Major banks will likely continue to do in-house upgrades to core systems, partner with fintechs, and launch new products that operate on separate, modern systems (like Goldman Sachs’ Marcus). Even smaller banks and credit unions have options, however, thanks to banking-as-a-service providers like Constellation, Payrailz, Sherpa, and other third-party companies that specialize in leapfrogging legacy system upgrades by providing platforms that financial institutions can plug into.

Of course, as Genovese says, changing the technology alone isn’t necessarily enough: “It’s people, process, and technology. You’ve got to change the mindset in an organization to have a digital transformation in terms of the culture.” Ultimately, changing habits and workflows alongside the tech stack may prove to be at least as challenging as the infrastructure upgrade itself.

The Line between Fintech and Finance Continues to Blur

While there’s still a distinct division between traditional financial firms and fintech startups, that gap will narrow in 2021. Established banks are investing, by necessity, more than ever before in modernizing their digital strategies, and fintechs are starting to encroach on their larger competitors’ territory. As Genovese points out, “The world is not stopping in terms of the players, the ecosystem, and consumers and their expectations fueled by the mobile device and the ability to do everything from the palm of your hand… If companies don’t meet that need, they’re not going to survive.”

2021, then, is likely to see quicker convergence between the capabilities of fintech companies and traditional finance than we might have otherwise expected. With user habits changing and companies committing to making those changes stick, it’s going to be a year that hopefully sees not only a lot of customer-facing improvements but which sets up a solid technological basis for future developments.