Good banking chatbots need to be not only user-friendly but useful. They should fill a real need, be trustworthy and likable, and, perhaps most importantly, should have well-understood limitations and an easy way to transfer users to human representatives when necessary.

There are a lot of pros to implementing a bot — as Germain Bahri, a digital banking consultant at Fidor Bank AG, says, they can provide “instant support, 24/7, personalized recommendations, ease of use and convenience, and powered by smart AI/ML, learn from previous requests and improve the experience over time.” However, especially in something as complex as finance, there are a lot of challenges involved in making a bot that people will be happy using.

Challenge 1: Knowing the Limits of Machines

Bots aren’t humans, and an important part of using them effectively is recognizing what they’re good at and quickly switching to a live representative when the conversation leaves that domain.

Jonathan Rangel, an ex-business analyst at Texas Capital Bank, sums up an average customer support bot quite well as something that “helps give attention to those that need help when a live person is not available.” On the bank’s side, he says “it will help free up staff that cannot directly attend to customers’ needs.”

The key consideration here is “when a live person is not available.” A lot of customer queries in banking are fairly complex and require humans for secure verification and accurate resolution, and, in those situations, bots can only take care of first support contact and triage.

Dan Hudson, CEO at BankmarkNuBank Group, sees chatbots as potentially a way to “screen and prequalify the request so a human that knows the operations of a bank can answer.” Any chatbot support system needs to be able to quickly identify problems that are out of its scope and make a seamless transition to a human rep.

That could be something the bot decides for itself, or it could be something that is continuously offered as an option — e.g., entering “representative” or tapping a button to speak with a human at any time. As Bahri says, a bot needs to be “responsive and easily redirected to a customer agent if needed.”

A 2018 survey by Aspect Software found that the ability to transfer to a live agent was important to 71% of consumers using AI support channels, and while that number may well go down as positive experiences with bots become more common, human interaction will always be the default preference for some.

Challenge 2: Making Sure It Adds Value

If a chatbot is more confusing or time-consuming to use than an app or a website, it’s not going to do much to enhance the customer experience. Simon Koci, the head of international partnerships at Dateio, points out that “they can be very counterproductive when the chatbot is bad.”

Having to constantly rephrase questions, muddling through confusing options, or dealing with misunderstood intents can put chatbots menus into the same frustration category as phone menus. Chatbots should be, as Bahri puts it, smart and responsive. A good banking bot will be able to understand and confirm a customer’s query and guide them through the steps they need to resolve it rather than requiring users to provide continuous clarification and input.

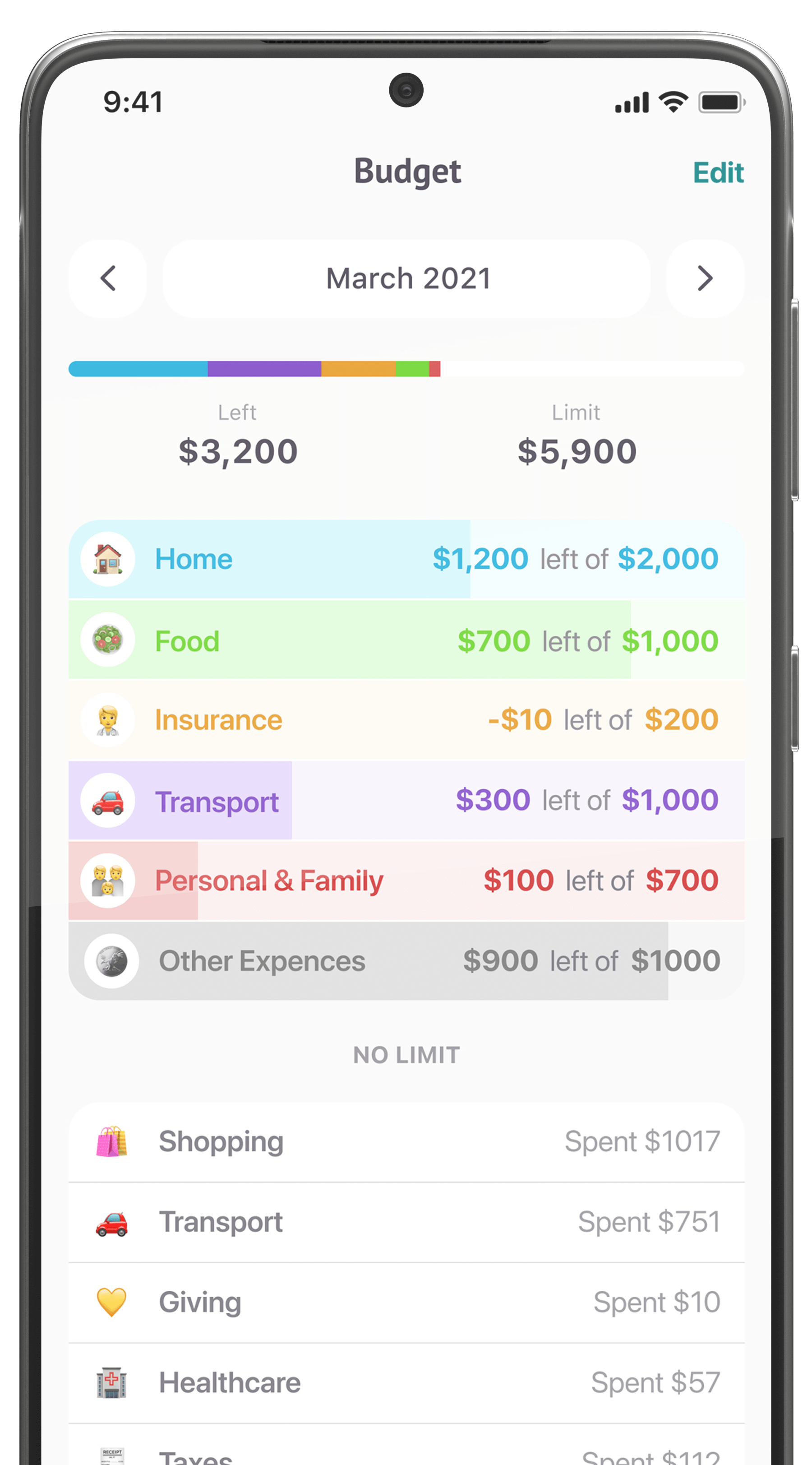

The artificial intelligence and conversation design needed to make sure bots are usably smooth, however, can be difficult and time-consuming to put together well. Banking chatbots will have to deal with a wide range of user needs, from, as Monica Hovsepian, senior global industry strategist of financial services at OpenText, points out, “simple questions such as account balance, recent transactions, or the location of the closest ATM or branch, to a more complex product or investment recommendations.” Dealing with so many different request types while still remaining simple and user-friendly is a major challenge. It may even be necessary to split different functions into multiple bots.

Challenge 3: Integrating with Other Channels

One of the best features of chatbots is that they can interact with customers on a highly personal and personalized level, providing a few high-visibility, high-quality recommendations and instantly responding to feedback. “Customer communication channels have become complex and customers choose their own preferred channels to engage with their institutions,” says Hovsepian. “Charting customer journeys has become more complex than ever and personalized engagement is now critical.” Doing that well requires both effective design and the technical expertise to hook up the bot’s frontend to a backend where it can access and store data.

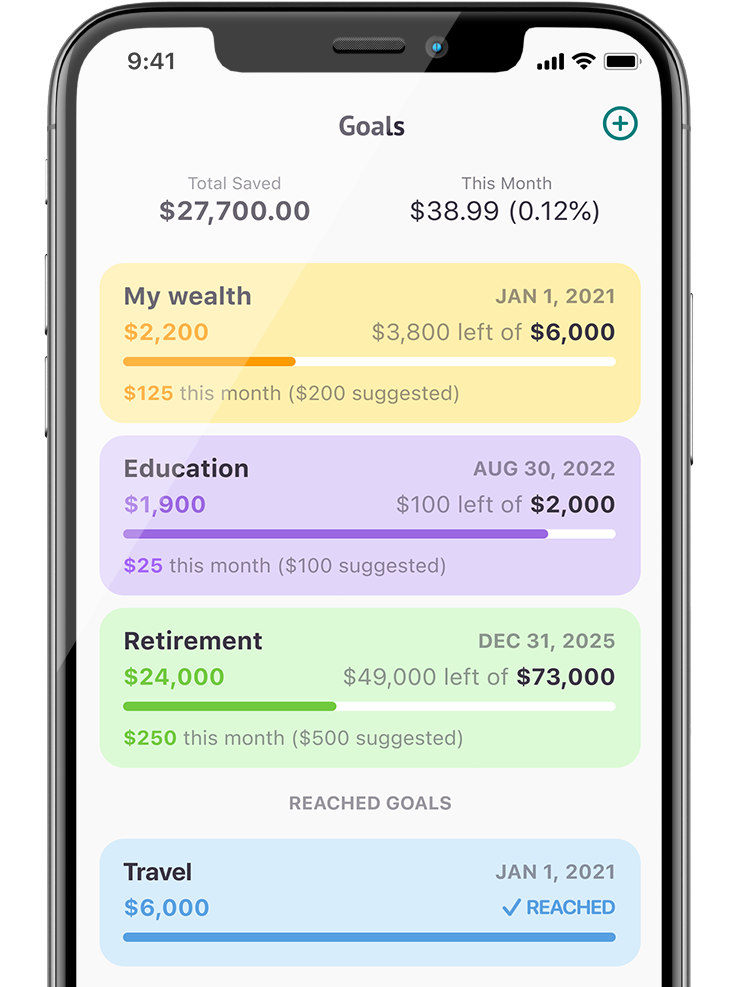

Simple chatbots can provide a basic level of personalization simply by letting users choose what they want to see, but if they’re to be proactive enough to fulfill their full marketing potential, they need to be effectively integrated into existing customer relationship management systems and product marketplaces. Sending a customer a message about a card with no foreign transaction fees could be very valuable if the customer has indicated any upcoming travel plans, but someone with no interest in international travel will probably see it as spam.

Likewise, bots need to be able to remember things they’ve learned about users, as asking the same question over and over again is not only somewhat annoying but can make the customer feel as if they’re being ignored. Progressing down a conversation tree can provide a type of short-term memory, but access to longer-term data is vital for recommendations and consistent personalization.

Challenge 4: Making the bots likable

Money and banking can be a sensitive topic, and the tone of a bot can make a big difference in how willing people are to continue using it. Like a good bank teller, a bot should give off an air of, primarily, competence, but with an undercurrent of friendliness.

Understanding the user and being equipped to help them are vital to a bot being likable—frustrated people aren’t likely to make friends—but even with those two basic needs met, a cold, formal bot probably isn’t going to bring as many people back to the platform or the brand.

Bots can’t say anything you don’t tell them to, so giving them a personality requires intentionally

identifying opportunities to use informal language, make jokes, and defuse potentially frustrating errors with human-sounding pleasantries. The bot doesn’t necessarily need to have a full backstory or be completely consistent in its tone, but people should have a rough idea of what to expect when they interact with it. This may be especially true for banking bots, as reliability and consistency are traits that financial institutions want to project as much as possible. Koci sees chatbots as being particularly useful for building brands and acquiring customers, and it’s thus wise to treat them as representatives of the company.

However, it’s best to avoid the “uncanny valley” of a bot that feels too human. Either users will feel betrayed when they figure out it’s a bot or they’ll a bit creeped out by a bot that’s almost human, but not quite enough.

Overcoming the challenges

Technical challenges, like integrating bots into existing systems and making them smart enough to correctly identify queries, generally require appropriate expertise to resolve. When it comes to design, though, there are a few general principles that, if followed, can head off a lot of issues:

- Keep it simple. Bots aren’t replacing humans—they’re replacing very specific individual things that humans can do. Conversation flows should be mostly linear, and users shouldn’t need to deal with too many choices or feel like they’re missing out on a potential path by selecting one.

- Keep it short. If users can’t at least get close to what they need in two or three responses, some other method would likely be more efficient and the bot really isn’t helping much.

- Keep it limited. Bots don’t have the informational bandwidth to display lots of different functions and options, so clearly defining a goal and staying within that limit is important.

- Keep it friendly. Don’t pretend to be a human—pretend to be a robot that likes humans. Look at your users’ demographics and create a bot that sounds at least a bit like they do.

Building and deploying a basic question-and-answer chatbot is something any fairly tech-savvy person with some time on their hands can do, but chatbots that. Chatbots that have to deal with complex inputs and multiple functions, though, can become hard to manage quickly. Starting with a strong awareness of the challenges and a dedication to keeping your bot simple and helpful will be very helpful as the process of creating and maintaining it unfolds.